Could XRP ETFs Generate $800 Million In First-Week Inflows Upon Approval?

Table of Contents

The Potential Demand for XRP ETFs

The potential for significant XRP ETF inflows rests heavily on the existing interest in XRP and the anticipated surge in demand following ETF approval.

Investor Appetite for XRP

XRP, the native cryptocurrency of Ripple, already boasts a substantial following. Its price history, while volatile, shows periods of significant growth, attracting both long-term holders and day traders.

- Price History: XRP has experienced substantial price fluctuations, demonstrating its potential for both gains and losses.

- Use Cases: Its primary use case within RippleNet, a global payment network facilitating cross-border transactions, adds to its appeal.

- Community Size: A large and active community of XRP holders and enthusiasts contributes to market demand and supports price.

Analyzing previous ETF launches provides context. The initial inflows for other successful ETFs have been substantial, suggesting that a similar pattern could emerge with XRP ETFs, potentially exceeding the $800 million mark, given the existing and anticipated interest.

Accessibility and Institutional Investment

XRP ETFs offer significantly improved accessibility compared to directly purchasing XRP. This is particularly crucial for institutional investors who often face stricter regulatory requirements and operational complexities when dealing with cryptocurrencies directly.

- Regulatory Clarity: ETFs provide a degree of regulatory clarity and compliance that many institutional investors require.

- Ease of Trading: Trading ETFs is typically simpler and more streamlined than navigating the complexities of cryptocurrency exchanges.

The involvement of large asset management firms is likely to significantly boost inflows. Their participation adds credibility and liquidity, attracting more investors and potentially pushing the first-week inflows well beyond the $800 million projection.

Factors Influencing the $800 Million Projection

The $800 million figure is ambitious, but several factors could contribute to its realization, while others might pose challenges.

Market Sentiment and Price Predictions

Positive market sentiment towards XRP is essential for driving substantial inflows into any XRP ETF. Expert price predictions paint a mixed picture, with some analysts forecasting significant price appreciation post-ETF approval, while others remain more cautious.

- Price Predictions: Analyst predictions vary widely, but several suggest a substantial price increase following SEC approval and ETF listing, potentially fueling considerable demand.

- Price Surge Correlation: A significant price surge directly correlates with increased ETF inflows as investors seek to capitalize on the upward momentum.

However, realizing these predictions hinges on various economic and market factors.

Regulatory Landscape and SEC Approval

SEC approval is paramount. The SEC's stance on cryptocurrencies has been historically cautious, posing potential hurdles to XRP ETF approval.

- SEC History: The SEC has shown a mixed record when it comes to approving crypto-related products.

- Potential Hurdles: Potential legal challenges or regulatory delays could significantly impact investor confidence and delay or diminish the projected inflows.

A delayed approval, or even rejection, could drastically reduce or eliminate the projected $800 million inflow within the first week.

Risks and Potential Challenges

While the potential for substantial inflows is considerable, various risks and challenges could affect the actual outcome.

Market Volatility and Uncertainty

The cryptocurrency market is notoriously volatile. Even with ETF approval, significant price swings are highly probable, affecting investor confidence and potentially reducing inflows.

- Inherent Risks: Investing in cryptocurrencies carries inherent risks, including the potential for substantial losses.

- Negative News Impact: Negative news, regulatory changes, or unforeseen events could trigger market sell-offs and impact inflows.

This inherent volatility makes predicting exact inflow figures extremely challenging.

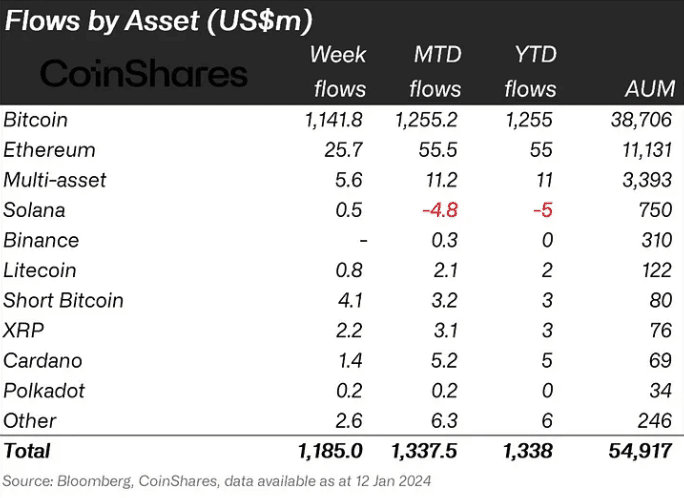

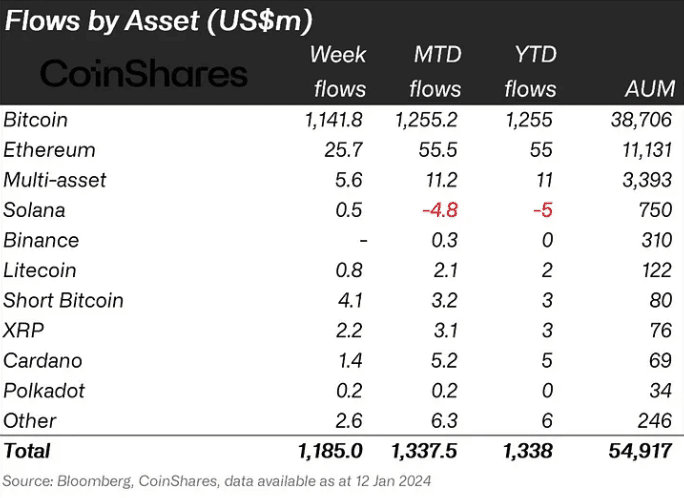

Competition from other Crypto ETFs

The presence of existing or future crypto ETFs will directly compete for investor funds. This competition could significantly impact the market share and subsequent inflows of XRP ETFs.

- Competing ETFs: Several other cryptocurrency ETFs are already available or in the pipeline, offering investors alternative investment options.

- Market Share Division: The market share will likely be divided among competing ETFs, influencing the success of any individual XRP ETF.

Conclusion

The potential for XRP ETFs to generate significant inflows, potentially reaching $800 million in the first week upon approval, is undeniable. However, this projection depends on several interconnected factors, including positive market sentiment, swift SEC approval, and the inherent volatility of the cryptocurrency market. While the accessibility and regulatory clarity offered by ETFs could attract substantial institutional and retail investment, competition from other crypto ETFs and the ever-present risk of market corrections should be considered.

The potential for XRP ETF investment is substantial. Stay updated on the latest regulatory news and market analysis to make informed decisions about incorporating XRP ETFs into your portfolio. Careful consideration of the risks and potential rewards associated with XRP ETF approval is crucial for navigating this exciting yet volatile market.

Featured Posts

-

Dominant First Inning Mariners 14 0 Shutout Of Marlins

May 07, 2025

Dominant First Inning Mariners 14 0 Shutout Of Marlins

May 07, 2025 -

The Karate Kid Legacy Examining Cobra Kais Continuity

May 07, 2025

The Karate Kid Legacy Examining Cobra Kais Continuity

May 07, 2025 -

Kumingas Return Fuels Warriors Victory Curry Kerr Hit Milestones Against Kings

May 07, 2025

Kumingas Return Fuels Warriors Victory Curry Kerr Hit Milestones Against Kings

May 07, 2025 -

Athletics Defeat Mariners Thanks To Langeliers Two Rbi Homer

May 07, 2025

Athletics Defeat Mariners Thanks To Langeliers Two Rbi Homer

May 07, 2025 -

Cleveland Cavaliers Dominant Performance Against Knicks Mitchell Mobley Shine

May 07, 2025

Cleveland Cavaliers Dominant Performance Against Knicks Mitchell Mobley Shine

May 07, 2025

Latest Posts

-

Warfare 5 Films That Capture Both Heart And Action

May 08, 2025

Warfare 5 Films That Capture Both Heart And Action

May 08, 2025 -

Ethereum Market Update Recent 67 M Liquidation Event And Future Outlook

May 08, 2025

Ethereum Market Update Recent 67 M Liquidation Event And Future Outlook

May 08, 2025 -

Ethereum Price Rally 2 000 On The Horizon

May 08, 2025

Ethereum Price Rally 2 000 On The Horizon

May 08, 2025 -

Is 2 000 The Next Stop For Ethereums Price

May 08, 2025

Is 2 000 The Next Stop For Ethereums Price

May 08, 2025 -

67 Million Ethereum Liquidated Analyzing The Market Impact

May 08, 2025

67 Million Ethereum Liquidated Analyzing The Market Impact

May 08, 2025