Credit Suisse Whistleblower Case: A $150 Million Settlement

Table of Contents

The Whistleblower's Allegations and the SEC Investigation

The Credit Suisse whistleblower case centers around serious allegations of financial fraud, including potential securities fraud and money laundering. The whistleblower, whose identity remains protected, provided crucial information to the Securities and Exchange Commission (SEC) regarding systemic weaknesses in Credit Suisse's internal controls and a pattern of misconduct. Keywords related to this section include whistleblower allegations, SEC investigation, financial fraud, securities fraud, money laundering, and internal reporting.

-

Specific Allegations: The whistleblower's detailed account included allegations of fraudulent activities spanning several years, potentially involving a range of financial instruments and clients. The exact nature of these allegations, due to confidentiality concerns, remains partially undisclosed, but they were substantial enough to trigger a comprehensive SEC investigation.

-

Scope of the SEC Investigation: The SEC's investigation was extensive, involving a thorough review of Credit Suisse's internal documents, employee interviews, and financial records. The investigation uncovered evidence supporting the whistleblower's claims, leading to the substantial settlement.

-

Evidence and the SEC's Case: The evidence presented by the whistleblower, corroborated by the SEC's investigation, painted a picture of significant compliance failures and a lack of effective internal controls within Credit Suisse. This failure to detect and prevent fraudulent activities led directly to the hefty penalties.

-

Internal Reporting Mechanisms: The case highlighted the critical need for robust internal reporting mechanisms. The whistleblower's ability to successfully report the alleged wrongdoing emphasizes the importance of clear, accessible, and protected channels for internal reporting. The lack of such effective mechanisms at Credit Suisse undoubtedly contributed to the scale of the problem.

The $150 Million Settlement and its Implications

The $150 million settlement represents a significant financial penalty for Credit Suisse. The settlement encompasses various components, including fines levied by regulatory bodies like the SEC and FINRA (Financial Industry Regulatory Authority), and potentially disgorgement of ill-gotten gains. Keywords for this section include settlement amount, financial penalties, regulatory consequences, reputational damage, and corporate responsibility.

-

Breakdown of the Settlement: The precise allocation of the $150 million among fines, disgorgement, and other costs isn't fully public, but it undoubtedly represents a substantial financial burden on the institution.

-

Impact on Credit Suisse's Finances: The settlement significantly impacts Credit Suisse's financial standing, affecting its profitability and shareholder value. The financial repercussions extend beyond the immediate settlement amount, impacting investor confidence and potentially future business opportunities.

-

Reputational Damage: The reputational damage to Credit Suisse is substantial. The association with financial crime and regulatory non-compliance erodes trust among clients, investors, and the broader public. This reputational damage can have long-term consequences, affecting the bank's ability to attract and retain clients and talent.

-

Implications for the Financial Industry: The settlement sends a clear message to the entire financial industry about the severity of regulatory consequences for failing to maintain robust compliance programs and internal controls. It underscores the rising costs of non-compliance and the increased scrutiny from regulatory bodies.

Impact on Whistleblower Protection Laws

The Credit Suisse case significantly impacts whistleblower protection laws, such as the Dodd-Frank Act and the Sarbanes-Oxley Act, by showcasing their effectiveness in uncovering financial wrongdoing. Keywords here include whistleblower protection, Dodd-Frank Act, Sarbanes-Oxley Act, legal ramifications, and incentives for whistleblowing.

-

Encouraging Whistleblowing: The substantial reward received by the whistleblower demonstrates the potential financial incentives for individuals to come forward with information about illegal activities. This incentivizes future whistleblowing, acting as a powerful deterrent to corporate misconduct.

-

Strengthening Whistleblower Protections: The case strengthens the argument for enhancing whistleblower protections to ensure that individuals who report wrongdoing are safeguarded from retaliation and are adequately rewarded for their contributions to uncovering financial crimes.

-

Increased Whistleblower Activity: The success of this case is likely to encourage more whistleblowers within the financial sector to report potential misconduct, leading to improved regulatory oversight and corporate accountability.

Lessons Learned and Best Practices for Corporate Governance

The Credit Suisse whistleblower case offers critical lessons for corporate governance and risk management within the financial industry. The keywords relevant to this section are corporate governance, risk management, internal controls, compliance programs, ethical conduct, and due diligence.

-

Importance of Strong Internal Controls: The case underscores the absolute necessity of strong internal controls and a robust compliance program. This includes regular audits, effective risk assessments, and clear lines of accountability.

-

Effective Internal Reporting Channels: Institutions must establish clear, accessible, and confidential internal reporting channels to encourage employees to report potential wrongdoing without fear of reprisal. This fosters a culture of open communication and transparency.

-

Ethical Leadership and Culture of Compliance: Ethical leadership is paramount. A culture of compliance, where ethical conduct is valued and prioritized at all levels of the organization, is essential to prevent future incidents.

-

Recommendations for Improvement: Financial institutions need to conduct thorough reviews of their internal controls and compliance programs, ensuring they meet the highest standards. This includes providing regular training to employees on ethical conduct and regulatory requirements.

Conclusion

The Credit Suisse whistleblower case and its $150 million settlement serve as a stark reminder of the crucial role of robust internal controls and effective whistleblower protection programs in maintaining ethical and legal conduct within the financial industry. The case underscores the severe consequences of failing to address systemic risks and the escalating importance of prioritizing regulatory compliance. The sheer scale of the financial penalty underscores the potential cost of overlooking even subtle indications of potential financial crimes.

Call to Action: Understanding the implications of the Credit Suisse whistleblower case is critical for all financial institutions. Learn more about strengthening your own corporate governance and compliance strategies to prevent similar costly and damaging events. Invest in comprehensive whistleblower programs and prioritize ethical conduct to mitigate risk and build trust. Explore resources on effective whistleblower programs and regulatory compliance today. Don't let a similar whistleblower case cost your institution millions; prioritize robust whistleblower protection and comprehensive compliance programs now.

Featured Posts

-

Soyuzniki Ukrainy Propustyat Parad 9 Maya V Kieve Analiz Politico

May 09, 2025

Soyuzniki Ukrainy Propustyat Parad 9 Maya V Kieve Analiz Politico

May 09, 2025 -

Strictly Come Dancing Katya Jones Departure And The Wynne Evans Allegations

May 09, 2025

Strictly Come Dancing Katya Jones Departure And The Wynne Evans Allegations

May 09, 2025 -

Khsart Alasnan Fy Marakana Qst Barbwza Almasawyt

May 09, 2025

Khsart Alasnan Fy Marakana Qst Barbwza Almasawyt

May 09, 2025 -

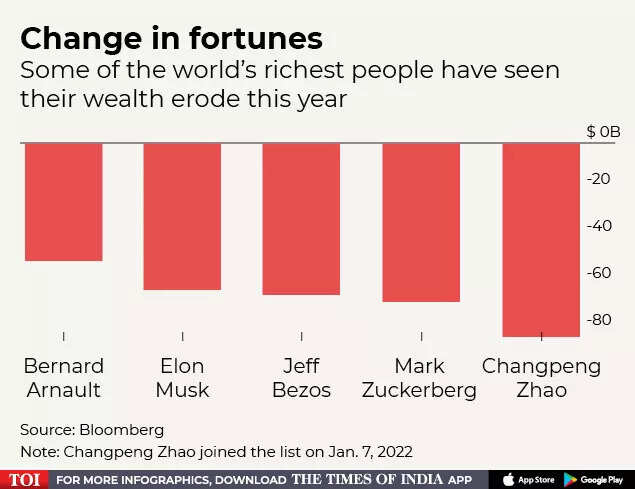

Estimating The Billions Lost By Elon Musk Jeff Bezos And Mark Zuckerberg Post Trump Inauguration

May 09, 2025

Estimating The Billions Lost By Elon Musk Jeff Bezos And Mark Zuckerberg Post Trump Inauguration

May 09, 2025 -

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025