Crypto Market Volatility: Billions In Bitcoin And Ethereum Options Expire This Week

Table of Contents

Understanding the Impact of Options Expiration

Options expiration in the crypto market refers to the date when a cryptocurrency options contract ceases to exist. The buyer of a call option has the right, but not the obligation, to buy the underlying cryptocurrency at a predetermined price (the strike price) on or before the expiration date. Similarly, the buyer of a put option has the right, but not the obligation, to sell the underlying cryptocurrency at the strike price. Large-scale expirations, like the billions of dollars worth of Bitcoin and Ethereum options expiring this week, can significantly influence price movements.

- Increased market activity leading up to expiration: As the expiration date approaches, traders actively adjust their positions, leading to increased trading volume and price fluctuations.

- Potential for sharp price swings due to large buy/sell orders: The simultaneous exercise or expiration of numerous options contracts can result in a surge of buy or sell orders, causing abrupt price changes.

- Impact on market liquidity: The sudden influx of orders around expiration can temporarily affect market liquidity, making it more challenging to buy or sell cryptocurrencies at desired prices.

- Role of institutional investors in options trading: Institutional investors' participation in options trading adds another layer of complexity, potentially amplifying price movements.

Reports suggest that billions of dollars worth of options are expiring this week, highlighting the magnitude of this event and its potential impact on crypto market volatility. This significant volume adds to the already unpredictable nature of the crypto market.

Factors Contributing to Crypto Market Volatility

Crypto market volatility is influenced by a complex interplay of factors. Understanding these factors is crucial for managing risk and making informed investment decisions.

-

Macroeconomic factors: Inflation rates, interest rate hikes, and overall economic uncertainty significantly impact investor sentiment and cryptocurrency prices. A strong correlation exists between traditional markets and the crypto market.

-

Regulatory news and government actions: Government regulations and announcements regarding cryptocurrency trading, taxation, and adoption heavily influence market sentiment and price stability. Positive regulatory developments tend to boost prices while negative news can trigger sell-offs.

-

Social media sentiment and market speculation: Social media platforms play a significant role in shaping market sentiment, often leading to rapid price increases or declines driven by hype or fear, particularly with meme coins. Influencer opinions and news cycles also play a role.

-

Impact of recent regulatory announcements: Recent regulatory actions from various governments globally have had a significant impact on crypto market volatility. These actions range from outright bans to more nuanced approaches, highlighting the risk associated with regulatory uncertainty.

-

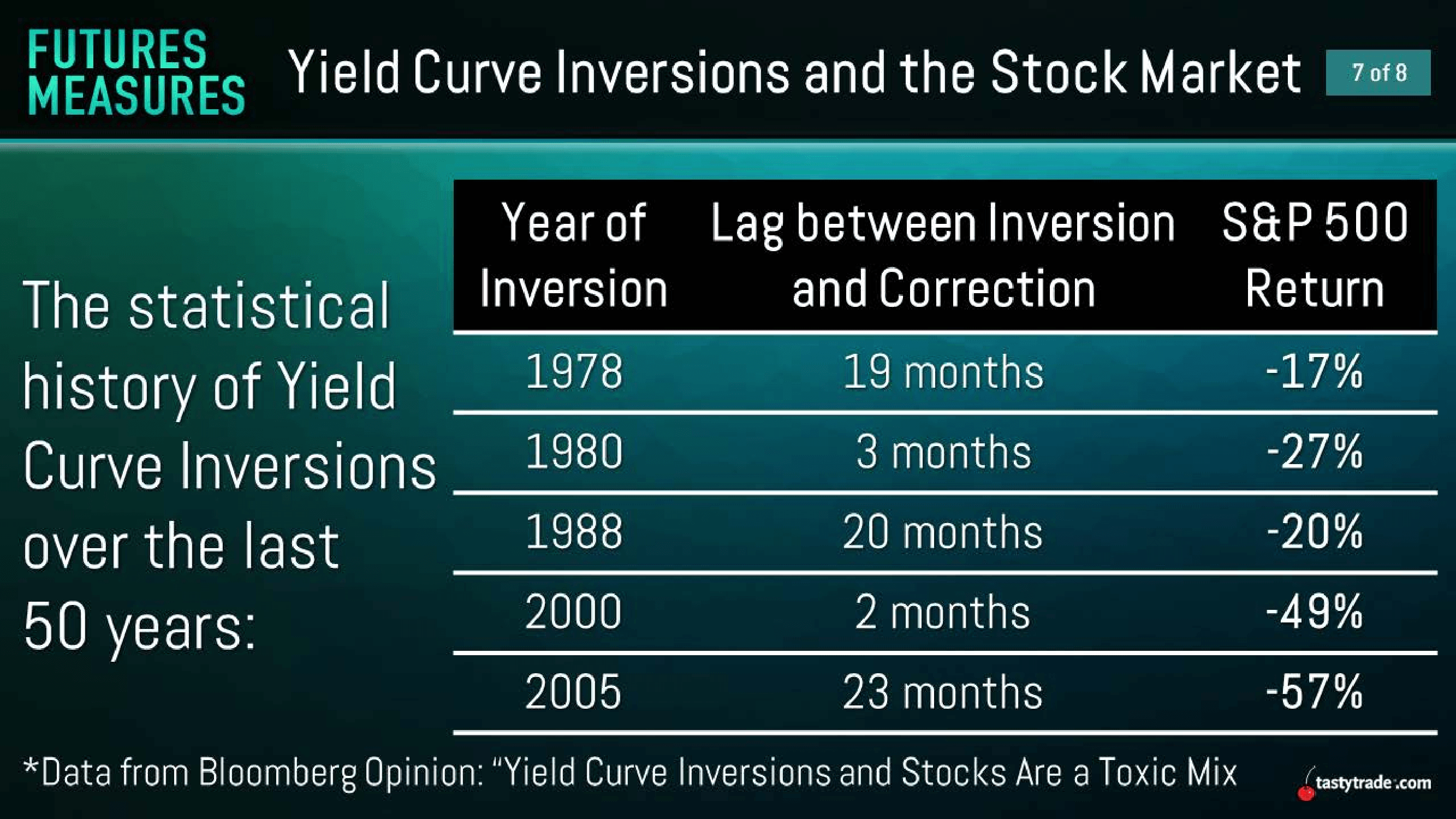

Correlation with traditional market indices: The crypto market shows a growing correlation with traditional financial markets, meaning that downturns in the stock market (like the S&P 500) can often trigger sell-offs in the crypto space.

-

Influence of prominent figures in the crypto space: Statements and actions from influential figures in the crypto industry can trigger significant price swings due to the market's sensitivity to news and opinions.

-

The role of news events (positive and negative): Positive news, such as successful blockchain upgrades or increased institutional adoption, can lead to bullish price action. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger market corrections.

Risk Management Strategies for Navigating Volatility

Navigating the volatile crypto market requires a robust risk management strategy. This involves understanding your risk tolerance, diversifying your portfolio, and employing appropriate risk mitigation techniques.

- Diversification: Diversifying across different cryptocurrencies (Bitcoin, Ethereum, and other altcoins) and asset classes (e.g., stocks, bonds) is crucial to reduce portfolio risk. Don't put all your eggs in one basket.

- Understanding your risk tolerance: Before investing in cryptocurrencies, assess your risk tolerance and invest only what you can afford to lose. Avoid impulsive decisions based on short-term market movements.

- Stop-loss orders: Stop-loss orders automatically sell your cryptocurrencies when the price falls below a predetermined level, limiting potential losses.

- Dollar-cost averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

- Leverage and margin trading: While potentially profitable, leverage and margin trading amplify both gains and losses, significantly increasing risk. Use these tools cautiously and only with a thorough understanding of the risks involved.

- Hedging strategies: Hedging strategies, like using options or futures contracts, can help mitigate risks by offsetting potential losses in one part of your portfolio with gains in another.

Specific Considerations for Bitcoin and Ethereum

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, exhibit unique volatility patterns.

- Bitcoin's role as the leading cryptocurrency: Bitcoin's price often acts as a benchmark for the entire crypto market, meaning its price movements can impact the value of other cryptocurrencies.

- Ethereum's ongoing network upgrades: Ethereum's ongoing network upgrades (like the shift to proof-of-stake) can significantly influence its price, presenting both opportunities and risks.

- Competition from other altcoins: The emergence of new altcoins and competing blockchain technologies can impact the market share and price of both Bitcoin and Ethereum.

- Institutional adoption: Increasing institutional adoption of Bitcoin and Ethereum can lead to price stability and growth, but this trend is also susceptible to market shifts.

Conclusion

The expiration of billions in Bitcoin and Ethereum options this week, combined with inherent crypto market volatility, creates a period of heightened uncertainty and risk. Understanding the underlying factors driving this volatility, employing effective risk management strategies, and diversifying your portfolio are crucial for navigating this challenging market environment. Stay informed about crypto market volatility and its impact on your investments. Continue to monitor news and analysis related to Bitcoin, Ethereum, and other cryptocurrencies to make informed decisions about your portfolio. Learn more about managing risk in the volatile world of crypto market volatility to protect your investments.

Featured Posts

-

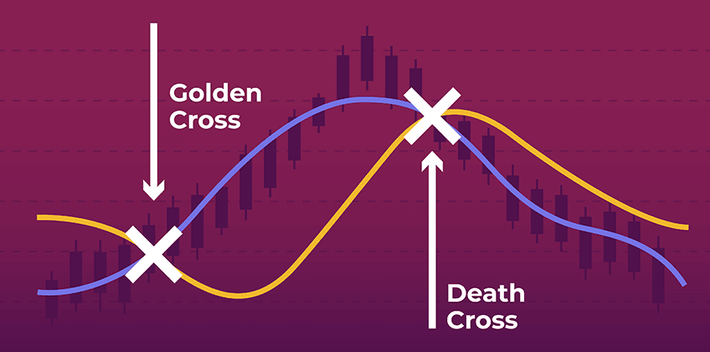

Bitcoins Golden Cross Historical Analysis And Future Predictions

May 08, 2025

Bitcoins Golden Cross Historical Analysis And Future Predictions

May 08, 2025 -

Intelligence Des Corneilles Un Talent Geometrique Remarquable

May 08, 2025

Intelligence Des Corneilles Un Talent Geometrique Remarquable

May 08, 2025 -

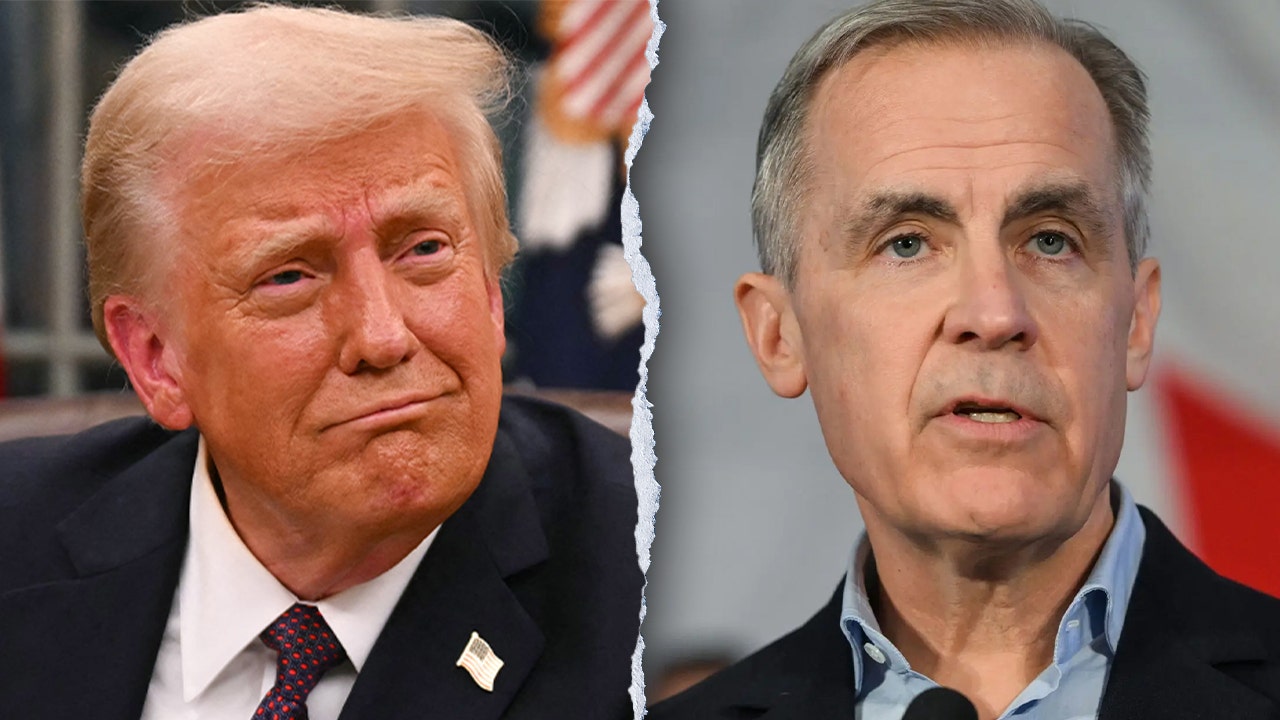

Trump A Transformational President Carneys D C Meeting Insights

May 08, 2025

Trump A Transformational President Carneys D C Meeting Insights

May 08, 2025 -

Should You Buy This Cryptocurrency Van Ecks 185 Forecast

May 08, 2025

Should You Buy This Cryptocurrency Van Ecks 185 Forecast

May 08, 2025 -

The Us China And Greenland A Geopolitical Tightrope

May 08, 2025

The Us China And Greenland A Geopolitical Tightrope

May 08, 2025

Latest Posts

-

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025 -

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025 -

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025