Easing Lending Restrictions: China's Response To Trade Tensions

Table of Contents

The Impact of Trade Tensions on the Chinese Economy

The trade war, characterized by escalating tariffs and trade barriers, significantly impacted China's economic growth. Chinese businesses, particularly those heavily reliant on exports, faced reduced demand and profitability. This led to a slowdown in investment, especially within export-oriented industries like manufacturing and technology. The need for robust economic stimulus measures became increasingly apparent to counteract the negative effects of the trade friction.

- Specific Industries Affected: Manufacturing (especially electronics and textiles), technology (semiconductors and telecommunications equipment), and agriculture experienced significant slowdowns.

- Quantifiable Data: China's GDP growth rate experienced a noticeable decline in the period following the intensification of trade tensions. Reports from the National Bureau of Statistics of China (NBSC) detailed the contraction in specific sectors.

Mechanisms of Easing Lending Restrictions

In response to the economic slowdown, the Chinese government implemented a series of measures to ease lending restrictions. These actions aimed to inject liquidity into the financial system and stimulate economic activity. Key mechanisms included:

- Reduced Reserve Requirements: The People's Bank of China (PBoC) lowered the reserve requirement ratio (RRR) for commercial banks, freeing up more capital for lending.

- Adjusted Loan-to-Value Ratios: The LTV ratios for mortgages and business loans were relaxed, making it easier for individuals and businesses to secure financing.

- Interest Rate Adjustments: The PBoC implemented cuts in benchmark interest rates, making borrowing cheaper and more accessible. This included adjustments to the Loan Prime Rate (LPR).

- New Lending Initiatives: The government introduced several targeted lending programs focused on specific sectors, such as infrastructure development and small and medium-sized enterprises (SMEs).

Targeted Support for Specific Sectors

The easing of lending restrictions wasn't uniformly applied across all sectors. The Chinese government prioritized certain industries deemed crucial for long-term economic growth and technological advancement.

- SMEs: Significant support was directed towards SMEs, recognizing their vital role in employment and innovation. Special loan programs with preferential interest rates were established.

- Technological Innovation: Industries related to technological innovation, such as renewable energy and artificial intelligence, received considerable funding to boost domestic capabilities and reduce reliance on foreign technologies.

- Infrastructure Development: Investment in infrastructure projects, including transportation and communication networks, continued to receive substantial government support through easier access to credit.

Potential Risks and Challenges of Eased Lending Restrictions

While the easing of lending restrictions aimed to stimulate the economy, it also carries inherent risks:

- Increased Non-Performing Loans (NPLs): Relaxed lending standards could lead to a rise in NPLs as businesses struggle to repay loans under challenging economic conditions.

- Asset Bubbles: Increased liquidity could inflate asset prices, creating unsustainable bubbles in the real estate or stock markets.

- Inflationary Pressures: The injection of large amounts of credit into the economy could fuel inflation, potentially eroding purchasing power.

- Long-Term Sustainability: The long-term sustainability of this policy depends on the effectiveness of structural reforms and the global economic environment.

Assessing the Long-Term Effects of Easing Lending Restrictions in China

China's easing of lending restrictions was a significant response to the economic challenges posed by trade tensions. While it aimed to stimulate growth and support key sectors, it also carries potential risks like increased NPLs and asset bubbles. The long-term effects will depend on several factors, including the effectiveness of targeted support programs, global economic conditions, and the government's ability to manage potential risks. To fully grasp the ongoing impact, continued monitoring of key economic indicators such as GDP growth, inflation, and NPL ratios is essential.

To stay updated on the evolving implications of China's economic policies, particularly regarding easing lending restrictions, further research is encouraged. Consult official reports from the PBoC and NBSC, and follow reputable financial news sources for in-depth analysis. Understanding the dynamics of China's easing lending restrictions is crucial for navigating the complexities of the global economy.

Featured Posts

-

New Play Station Plus Premium And Extra Games For March 2024 Announced

May 08, 2025

New Play Station Plus Premium And Extra Games For March 2024 Announced

May 08, 2025 -

Hot Toys Reveals Japan Exclusive Galen Erso Rogue One Collectible Figure

May 08, 2025

Hot Toys Reveals Japan Exclusive Galen Erso Rogue One Collectible Figure

May 08, 2025 -

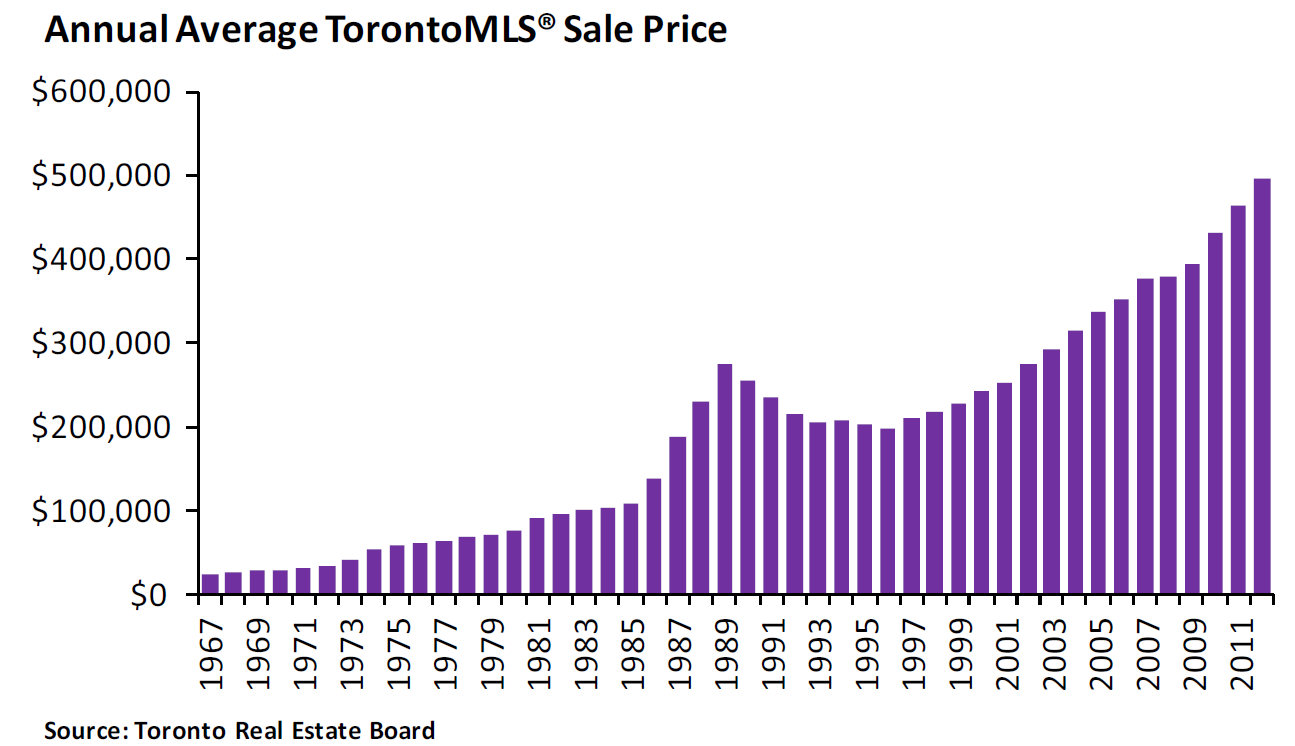

Analysis Of Torontos Housing Market 23 Sales Decline 4 Price Dip

May 08, 2025

Analysis Of Torontos Housing Market 23 Sales Decline 4 Price Dip

May 08, 2025 -

When Does Forza Horizon 5 Launch On Play Station 5

May 08, 2025

When Does Forza Horizon 5 Launch On Play Station 5

May 08, 2025 -

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Latest Posts

-

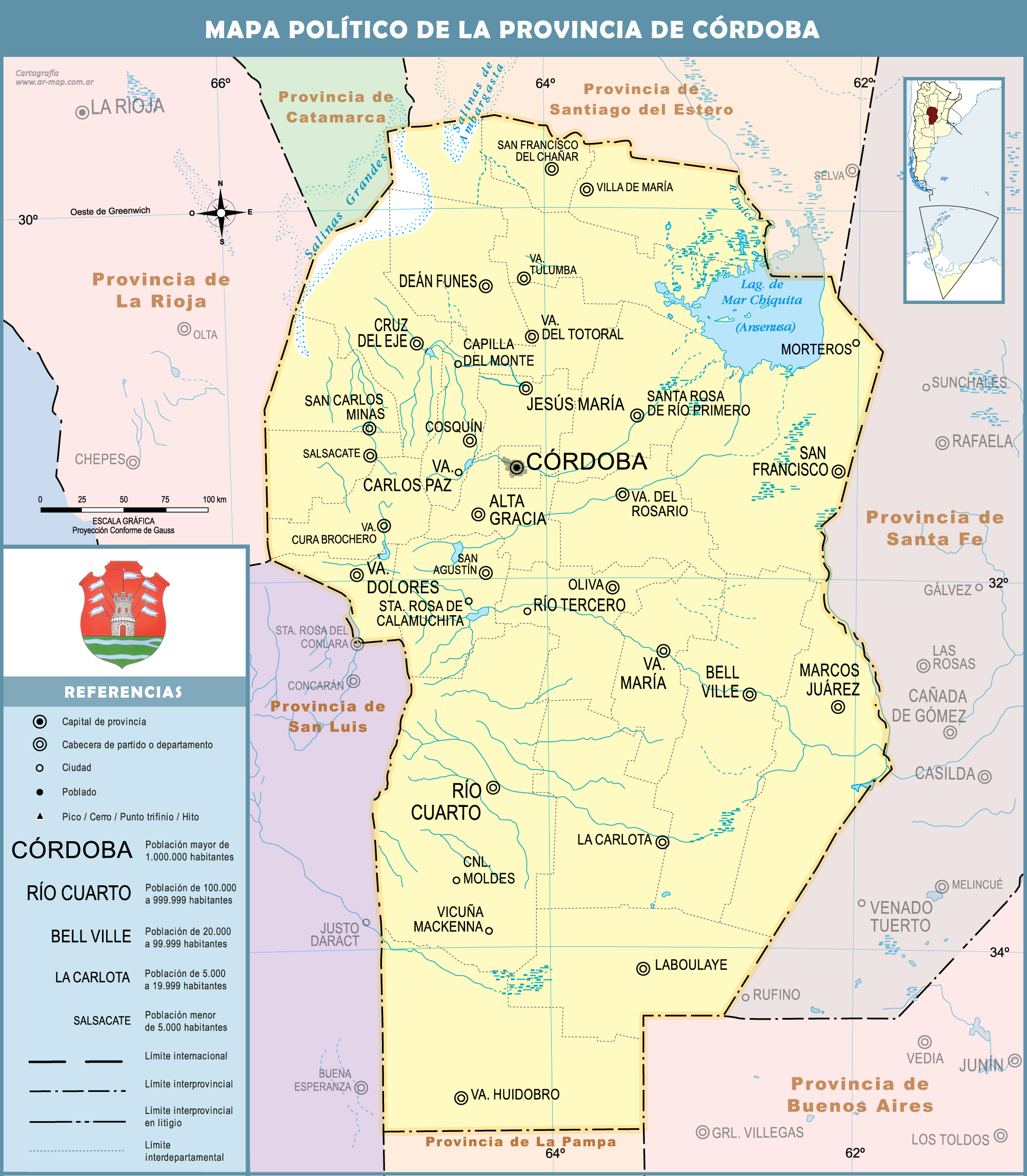

Central Evaluacion De Su Salud Futbolistica Segun El Instituto De Cordoba Gigante De Arroyito

May 08, 2025

Central Evaluacion De Su Salud Futbolistica Segun El Instituto De Cordoba Gigante De Arroyito

May 08, 2025 -

El Gigante De Arroyito Analisis Del Instituto De Cordoba Sobre La Salud Futbolistica De Central

May 08, 2025

El Gigante De Arroyito Analisis Del Instituto De Cordoba Sobre La Salud Futbolistica De Central

May 08, 2025 -

Informe Sobre La Salud De Central Perspectiva Del Instituto De Cordoba Desde El Gigante De Arroyito

May 08, 2025

Informe Sobre La Salud De Central Perspectiva Del Instituto De Cordoba Desde El Gigante De Arroyito

May 08, 2025 -

Central Y Su Buen Estado De Forma En El Gigante De Arroyito Analisis Del Instituto De Cordoba

May 08, 2025

Central Y Su Buen Estado De Forma En El Gigante De Arroyito Analisis Del Instituto De Cordoba

May 08, 2025 -

Instituto De Cordoba El Estado De Salud De Central En El Gigante De Arroyito

May 08, 2025

Instituto De Cordoba El Estado De Salud De Central En El Gigante De Arroyito

May 08, 2025