G-7 Weighs De Minimis Tariff Adjustments For Chinese Imports

Table of Contents

Understanding "De Minimis" in International Trade

In the realm of international trade, "de minimis" refers to the threshold value of imported goods below which tariffs and other customs duties are waived. Essentially, it's a low-value exemption designed to streamline the import process for small shipments. De minimis thresholds significantly impact small businesses and individuals engaging in cross-border e-commerce, as shipments falling below this value are exempt from cumbersome customs procedures.

The current de minimis thresholds vary widely across G7 countries. For instance, some nations have set their thresholds relatively high, while others maintain lower levels. This variation creates an uneven playing field for businesses importing from China.

- Definition of de minimis value: The specific monetary value below which import duties are waived.

- Impact on small businesses importing from China: Lower thresholds disproportionately affect small businesses relying on affordable imports.

- Comparison of current de minimis levels across G7 nations: Significant discrepancies exist, leading to competitive imbalances.

- Mention of the role of customs agencies in enforcing these thresholds: Customs agencies play a vital role in implementing and monitoring these regulations.

The G-7's Rationale for Considering Adjustments

The G7's consideration of de minimis tariff adjustments for Chinese imports stems from a complex interplay of economic and political factors. Domestic industries face pressure from cheaper Chinese imports, potentially leading to job losses and reduced competitiveness. There are also concerns about unfair trade practices originating from China. These concerns are fueling the debate over whether adjustments are needed to protect domestic businesses.

Simultaneously, altering de minimis thresholds could have far-reaching consequences for inflation and consumer prices. Increasing the threshold could lead to cheaper imports, potentially benefitting consumers but potentially hurting domestic producers. Conversely, lowering the threshold could increase the cost of imports, impacting consumers but possibly strengthening domestic production.

- Concerns about unfair competition from Chinese imports: Allegations of dumping and subsidies from Chinese exporters fuel this debate.

- Pressure from domestic businesses seeking protection: Industries lobbying for higher tariffs to safeguard their market share.

- Potential impact on supply chain stability: Changes could disrupt existing supply chains and create uncertainty for businesses.

- Analysis of the economic effects of raising or lowering de minimis thresholds: A thorough cost-benefit analysis is critical for informed decision-making.

Potential Impacts of De Minimis Tariff Adjustments

Adjusting de minimis thresholds carries significant implications for businesses of all sizes and consumers. Raising the threshold could make importing from China more attractive for small and medium-sized enterprises (SMEs), potentially boosting their competitiveness. However, it could also lead to increased competition for domestic businesses. Lowering the threshold would have the opposite effect, potentially benefiting domestic businesses but potentially increasing costs for consumers.

- Impact on small and medium-sized enterprises (SMEs): A crucial consideration, as SMEs often rely on affordable imports.

- Effect on large corporations importing from China: Large corporations may be less affected by minor threshold changes.

- Changes in consumer spending patterns: Higher import costs could alter consumer behavior and purchasing choices.

- Potential shifts in global trade flows: Adjustments could cause shifts in supply chains and trade relationships.

International Trade Law and Implications

Any significant changes to de minimis thresholds must align with World Trade Organization (WTO) rules and regulations. The WTO framework governs international trade, and substantial adjustments could trigger disputes and legal challenges. Moreover, China is likely to respond to any perceived protectionist measures, potentially leading to retaliatory tariffs or other trade restrictions.

- WTO rules and regulations on de minimis: Understanding these rules is crucial to avoid potential trade conflicts.

- Potential disputes and trade conflicts: Significant changes could trigger disputes and retaliatory measures.

- China’s likely response to changes in de minimis thresholds: Predicting China’s reaction is vital for assessing the overall consequences.

- Legal implications for businesses involved in importing from China: Businesses need to be aware of the legal ramifications of any changes.

Conclusion

The G-7's contemplation of de minimis tariff adjustments for Chinese imports is a complex issue with significant consequences for businesses and consumers alike. Raising the threshold could stimulate cheaper imports and benefit SMEs, but it might also hurt domestic industries. Lowering the threshold could protect domestic industries, but it would likely lead to higher prices for consumers. The legal implications, particularly in relation to WTO rules and the potential for retaliatory measures from China, are equally significant. Staying informed about further developments regarding de minimis tariff adjustments and engaging in discussions about the implications of these potential changes is crucial. For in-depth analysis, consult resources such as WTO publications and reports from reputable economic organizations. Understanding the nuances of de minimis tariff adjustments for Chinese imports is paramount for navigating the evolving global trade landscape.

Featured Posts

-

Trumps Tariff Decision 8 Stock Market Surge On Euronext Amsterdam

May 25, 2025

Trumps Tariff Decision 8 Stock Market Surge On Euronext Amsterdam

May 25, 2025 -

Luxury And Politics An Examination Of Presidential Seals High End Watches And Exclusive Events

May 25, 2025

Luxury And Politics An Examination Of Presidential Seals High End Watches And Exclusive Events

May 25, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025

Accenture Announces 50 000 Promotions Following Delay

May 25, 2025 -

Nashe Pokolenie Itogi I Perspektivy Razvitiya

May 25, 2025

Nashe Pokolenie Itogi I Perspektivy Razvitiya

May 25, 2025 -

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Chotiri Favoriti

May 25, 2025

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Chotiri Favoriti

May 25, 2025

Latest Posts

-

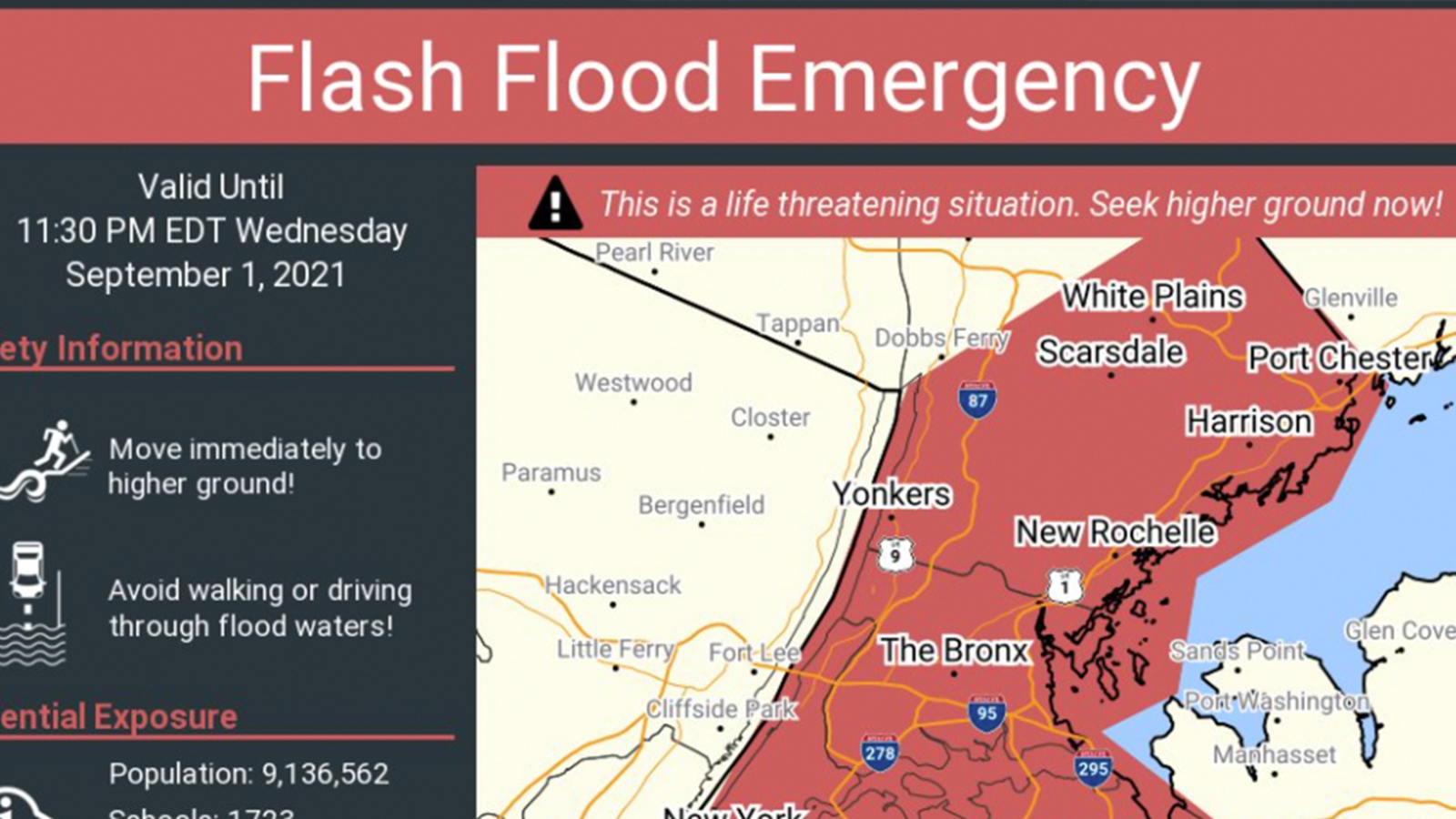

Flash Flood Safety Recognizing Flood Warnings And Taking Action

May 25, 2025

Flash Flood Safety Recognizing Flood Warnings And Taking Action

May 25, 2025 -

Understanding Flash Floods A Guide To Flood Warnings And Safety

May 25, 2025

Understanding Flash Floods A Guide To Flood Warnings And Safety

May 25, 2025 -

Flash Flood Warning What To Know About Potential Flood Alerts

May 25, 2025

Flash Flood Warning What To Know About Potential Flood Alerts

May 25, 2025 -

Bradford And Wyoming Counties Flash Flood Warning In Effect Until Tuesday

May 25, 2025

Bradford And Wyoming Counties Flash Flood Warning In Effect Until Tuesday

May 25, 2025 -

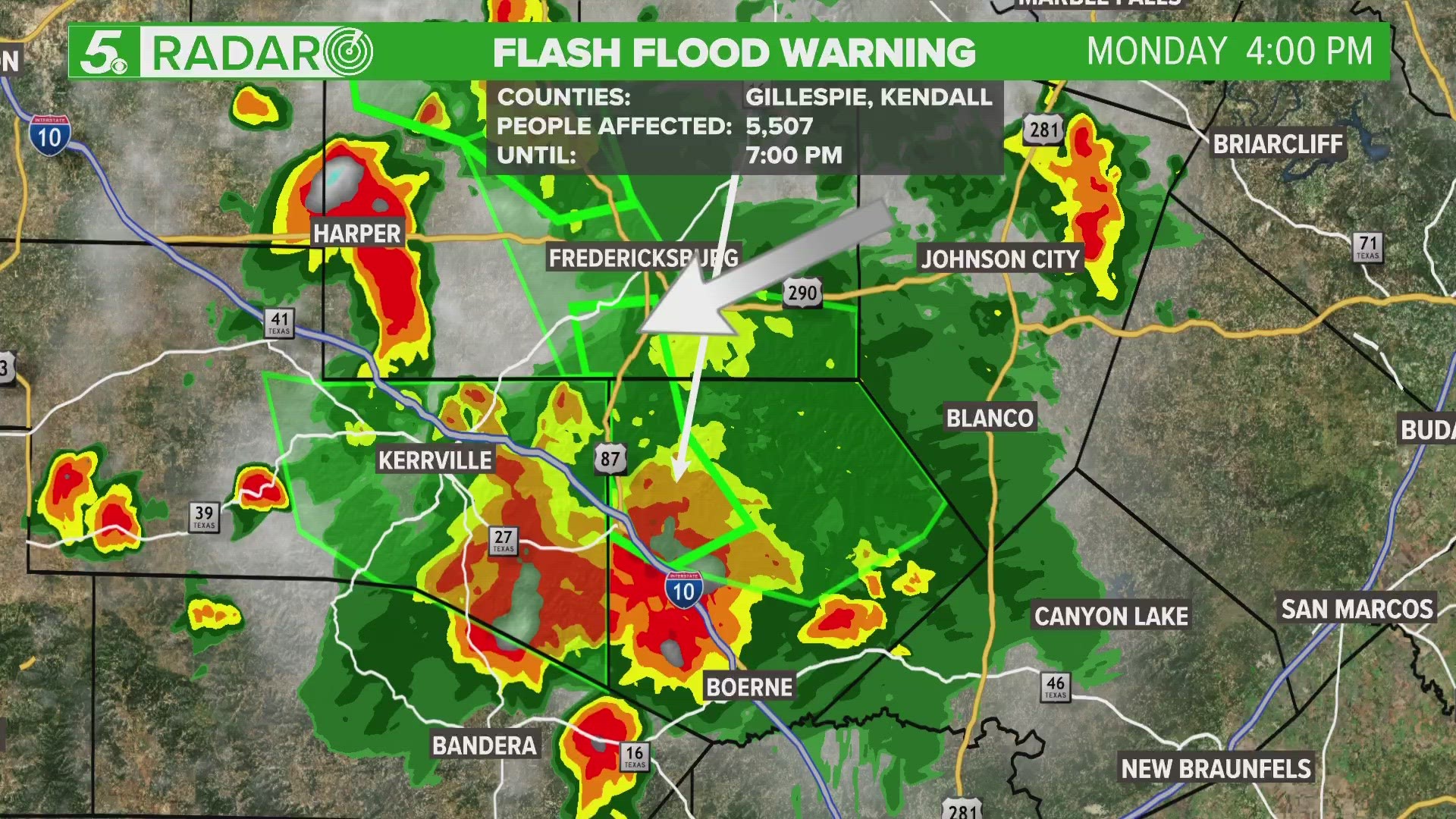

Flash Flood Emergency In Texas North Central Areas Under Downpour

May 25, 2025

Flash Flood Emergency In Texas North Central Areas Under Downpour

May 25, 2025