High Down Payments: The Canadian Homeownership Hurdle

Table of Contents

The Rising Cost of Down Payments in Canada

The dream of owning a home in Canada is becoming increasingly expensive, largely due to the significant increase in required down payments. This section explores the factors driving this trend and the regional variations involved.

Impact of Inflation and Housing Prices

Soaring inflation and rapidly escalating housing prices have drastically increased the amount needed for a down payment, making homeownership a distant reality for many Canadians. Over the past five years, average home prices in major Canadian cities have seen dramatic increases.

- Toronto: Average home prices have increased by an estimated X% (insert actual percentage data), meaning a 5% down payment on an average home now requires $Y (insert calculated amount) compared to $Z (insert calculated amount) five years ago.

- Vancouver: Similar increases have been observed in Vancouver, with average home prices rising by approximately X% (insert actual percentage data), requiring a down payment of $Y (insert calculated amount) today versus $Z (insert calculated amount) five years prior.

- Montreal & Calgary: While slightly lower than Toronto and Vancouver, Montreal and Calgary have also experienced significant price increases, impacting the affordability of high down payments. (Insert comparable data for these cities).

This dramatic rise in home prices significantly outpaces the growth in average household incomes. According to [cite source – Statistics Canada or a reputable real estate agency], the average household income in Canada is $X (insert data), making it challenging to save for the substantial down payments required in many markets. This widening gap between income and housing costs is a key driver of the current Canadian homeownership crisis.

Regional Variations in Down Payment Requirements

The challenges posed by high down payments vary considerably across Canada. Regional differences in housing costs significantly impact the amount needed for a down payment.

- Toronto and Vancouver: These cities consistently rank among the most expensive in Canada, requiring substantially larger down payments than other regions.

- Calgary and Montreal: These cities generally have lower average home prices, resulting in lower down payment requirements, although the cost of living can still be a major factor.

- Smaller Cities and Rural Areas: While affordability is generally higher in smaller cities and rural areas, securing financing can present different challenges.

Some provincial governments are introducing initiatives to address the issue of affordability. For instance, [mention specific provincial programs, linking to relevant government websites]. However, these programs often have specific eligibility criteria, making them inaccessible to many potential homeowners.

The Impact on First-Time Homebuyers

The burden of high down payments disproportionately affects first-time homebuyers, who often face unique financial constraints.

Difficulty Saving for a Down Payment

First-time homebuyers often juggle multiple financial priorities, including student loan debt, car payments, and rent. Saving a substantial down payment presents a significant challenge.

- Time to Save: Based on current average salaries and home prices, saving a 20% down payment can take [insert estimated timeframe] in major cities like Toronto and Vancouver. This timeframe can be significantly shorter in smaller urban centers.

- Competing Priorities: Many young Canadians face competing financial demands, making it difficult to prioritize saving for a down payment.

- Limited Savings Opportunities: Low interest rates on savings accounts and the limited availability of high-yield savings options make saving for a significant down payment even more challenging.

Anecdotal evidence from various online forums and personal finance blogs highlights the struggles faced by many first-time homebuyers in saving for a down payment.

Alternative Financing Options and Their Limitations

Several alternative financing options can assist first-time homebuyers, but they often come with limitations.

- Shared Equity Mortgages: These mortgages allow buyers to purchase a home with a smaller down payment, with the lender sharing in the equity appreciation. However, eligibility criteria can be restrictive.

- Government-Backed Programs: Programs like the Canada Mortgage and Housing Corporation (CMHC) offer various mortgage insurance options that allow for lower down payments. But these often come with higher interest rates and additional insurance premiums.

- Down Payment Assistance Programs: Some provinces and municipalities offer down payment assistance programs, but these are typically limited in scope and highly competitive. [Provide examples and links to these programs where possible].

Understanding the benefits and limitations of each option is crucial for aspiring homeowners.

Potential Solutions and Policy Recommendations

Addressing the challenge of high down payments requires a multi-faceted approach involving both government intervention and innovation within the financial sector.

Government Intervention and Affordable Housing Initiatives

The government plays a crucial role in fostering a more accessible housing market.

- Increased Funding for Affordable Housing: Significant investment in affordable housing projects is essential to increase the supply of affordable homes.

- Tax Incentives for First-Time Homebuyers: Tax breaks or deductions could help first-time buyers save for a down payment faster.

- Adjusting Mortgage Stress Tests: Modifying stress tests to reflect current market conditions could potentially make mortgages more accessible.

The Role of Financial Institutions

Financial institutions can also contribute to improving affordability.

- Flexible Mortgage Options: Banks and other lenders should explore offering more flexible mortgage options with lower down payment requirements, potentially coupled with stricter lending criteria to mitigate risk.

- Increased Access to Down Payment Assistance Programs: Financial institutions can play a vital role in expanding access to down payment assistance programs, working in collaboration with government initiatives.

Conclusion

High down payments pose a significant barrier to Canadian homeownership, especially for first-time buyers. The widening gap between housing costs and income necessitates a collaborative effort between governments and financial institutions. Increasing investment in affordable housing, introducing innovative lending practices, and potentially re-evaluating down payment requirements are crucial steps towards making the dream of homeownership a reality for more Canadians. To navigate the challenges of high down payments and explore available solutions, research government-backed programs and financial assistance options designed to support Canadian homeownership.

Featured Posts

-

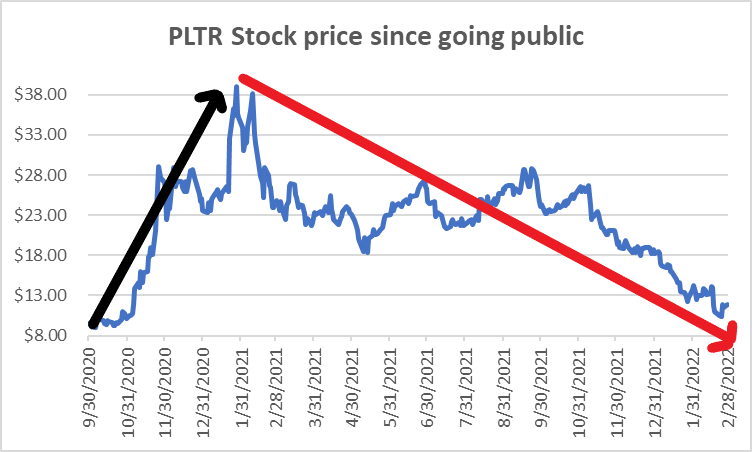

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 09, 2025

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 09, 2025 -

Infineon Ifx Sales Guidance Tariff Uncertainty Impacts Estimates

May 09, 2025

Infineon Ifx Sales Guidance Tariff Uncertainty Impacts Estimates

May 09, 2025 -

Todays Sensex And Nifty Sharp Gains Across All Sectors Market Update

May 09, 2025

Todays Sensex And Nifty Sharp Gains Across All Sectors Market Update

May 09, 2025 -

Edmonton Oilers Leon Draisaitl Hart Trophy Contender And Banner Year

May 09, 2025

Edmonton Oilers Leon Draisaitl Hart Trophy Contender And Banner Year

May 09, 2025 -

Strands Nyt Crossword Answers Saturday February 15th Game 349

May 09, 2025

Strands Nyt Crossword Answers Saturday February 15th Game 349

May 09, 2025