Is The Ethereum Price Poised For An Uptrend?

Table of Contents

Analyzing Current Market Conditions for Ethereum

Understanding the current market landscape is crucial for any Ethereum price prediction. We'll examine macroeconomic factors, technical analysis, and on-chain metrics to paint a clearer picture.

Macroeconomic Factors Influencing Crypto Markets

The cryptocurrency market, including Ethereum, is highly sensitive to macroeconomic conditions. Overall market sentiment plays a significant role; a bullish market generally favors higher crypto prices, while a bearish market often leads to declines.

-

Inflation and Interest Rates: High inflation and rising interest rates typically put downward pressure on risk assets, including cryptocurrencies. Investors may shift towards safer, less volatile investments.

-

Recessionary Fears: Fears of a recession can further dampen investor appetite for riskier assets like Ethereum, leading to price drops.

-

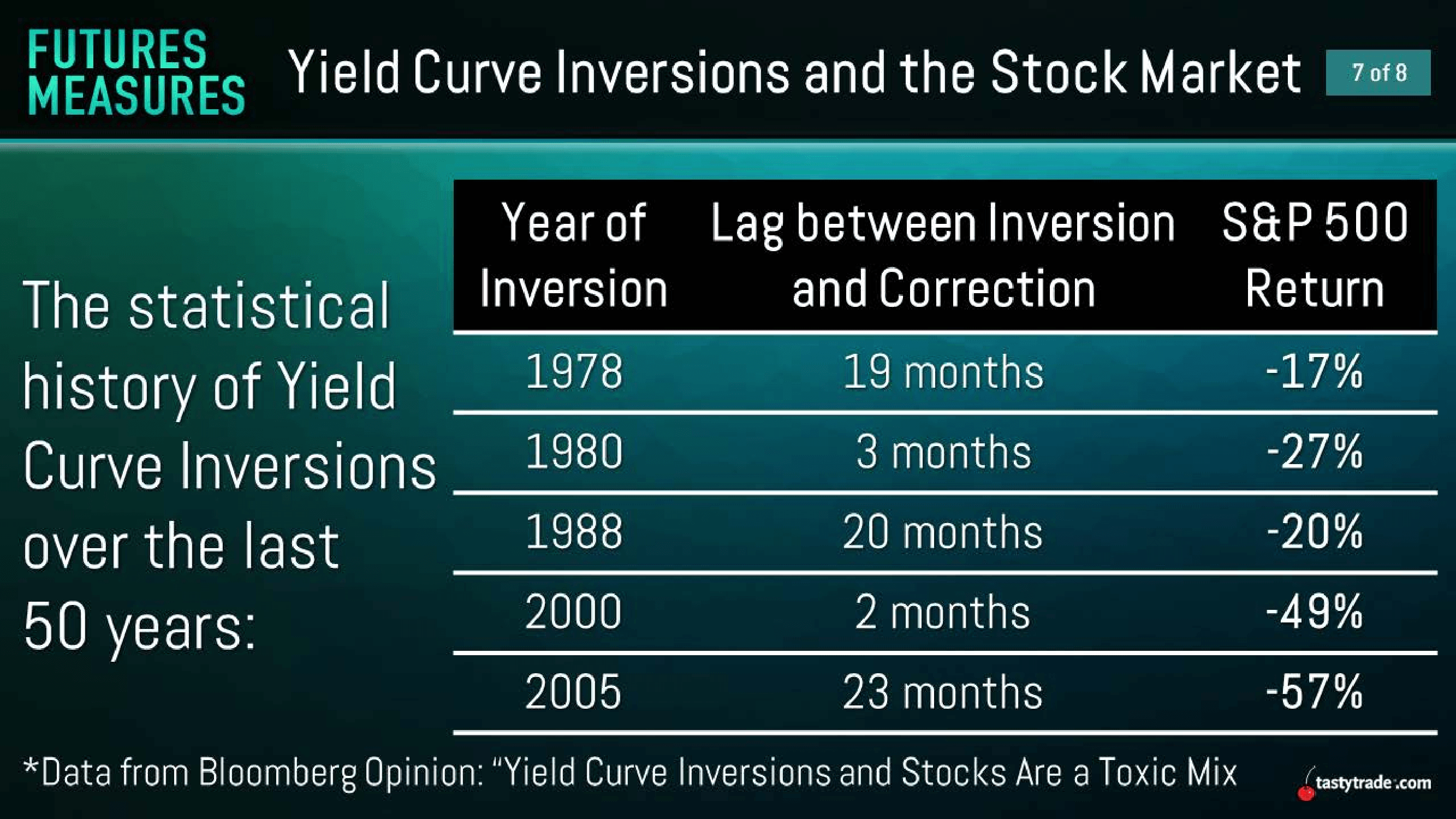

Correlation with Traditional Markets: While crypto markets often exhibit independent behavior, there's a degree of correlation with traditional markets. Negative performance in stocks or bonds can sometimes spill over into the crypto space.

-

Examples:

- The 2022 inflation surge and subsequent interest rate hikes by central banks globally significantly impacted the Ethereum price.

- Fears of a recession in late 2022 contributed to a substantial drop in the overall crypto market capitalization, including Ethereum.

Technical Analysis of Ethereum's Price Chart

Technical analysis offers insights into potential price movements based on historical data. Analyzing charts helps identify key support and resistance levels, chart patterns, and the strength of price trends.

-

Support and Resistance: Support levels represent prices where buying pressure is expected to outweigh selling pressure, preventing further declines. Resistance levels represent prices where selling pressure is likely to dominate, halting upward momentum.

-

Moving Averages: Moving averages smooth out price fluctuations, providing insights into the overall trend. A bullish crossover (short-term average crossing above a long-term average) is often considered a positive signal.

-

RSI (Relative Strength Index): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

-

Examples:

- A break above a significant resistance level could signal the beginning of an Ethereum uptrend.

- A bearish divergence (price making higher highs, while RSI makes lower highs) might suggest a weakening uptrend.

Ethereum's On-Chain Metrics & Network Activity

Analyzing on-chain data provides valuable insights into the health and activity of the Ethereum network.

-

Transaction Volume and Active Addresses: Higher transaction volume and active addresses indicate increased network usage and potential for price appreciation.

-

Gas Fees: Gas fees reflect the cost of transactions on the Ethereum network. High gas fees can be a sign of high demand, but also potentially deter users.

-

Ethereum Supply: The total supply of Ethereum influences its price. A decrease in supply (due to burning mechanisms) can contribute to price increases.

-

Examples:

- A surge in daily transaction volume and active addresses could be a bullish sign for the Ethereum price.

- A significant drop in gas fees might suggest reduced network activity and potential downward price pressure.

Upcoming Ethereum Developments & Their Price Implications

Several upcoming developments and ongoing projects hold significant implications for the Ethereum price.

The Merge and its Long-Term Effects

The successful transition to proof-of-stake (PoS) drastically reduced Ethereum's energy consumption and improved its scalability.

-

Reduced Energy Consumption: PoS significantly lowered Ethereum's environmental impact, potentially attracting environmentally conscious investors.

-

Improved Scalability: PoS enhanced the network's capacity to handle transactions, leading to reduced congestion and lower gas fees.

-

Deflationary Nature: The burning of ETH during transactions contributes to a deflationary model, potentially increasing its value over time.

-

Examples:

- The Merge itself resulted in a temporary price dip followed by a period of relative stability.

- The long-term impact of the Merge on Ethereum's price is still unfolding and is subject to market dynamics.

Ethereum Layer-2 Scaling Solutions

Layer-2 solutions, such as Optimism and Arbitrum, significantly improve Ethereum's scalability by processing transactions off-chain.

-

Reduced Transaction Fees: Layer-2 solutions reduce transaction costs, making Ethereum more accessible to a wider range of users.

-

Increased Throughput: Layer-2 solutions increase the network's capacity to process transactions, improving speed and efficiency.

-

Examples:

- The increasing adoption of layer-2 solutions has the potential to boost Ethereum's overall usability and attract more developers and users.

Development and Adoption of Ethereum-based Applications (dApps)

The thriving DeFi and NFT ecosystems built on Ethereum are crucial drivers of its value.

-

DeFi Growth: The decentralized finance (DeFi) sector continues to expand, with new protocols and applications constantly emerging.

-

NFT Market: Non-fungible tokens (NFTs) remain a significant part of the Ethereum ecosystem, driving demand and transaction volume.

-

Examples:

- The continued success of major DeFi protocols and the emergence of innovative NFT projects contribute to the overall demand for Ethereum.

Potential Risks and Challenges for Ethereum's Uptrend

Despite the positive factors, several risks could hinder an Ethereum uptrend.

Regulatory Uncertainty and Government Intervention

Regulatory uncertainty remains a significant threat to the cryptocurrency market.

-

Government Crackdowns: Governments worldwide are grappling with how to regulate cryptocurrencies, leading to potential crackdowns or bans.

-

Varying Regulatory Approaches: Different countries have different regulatory approaches, creating uncertainty and complexity for investors and businesses.

-

Examples:

- Increased regulatory scrutiny in certain jurisdictions could negatively impact the Ethereum price.

Competition from Other Blockchains

Ethereum faces competition from other smart contract platforms.

-

Alternative Blockchains: Several alternative blockchains aim to challenge Ethereum's dominance, offering faster transaction speeds or lower fees.

-

Examples:

- Solana, Cardano, and others offer features that could attract developers and users away from Ethereum.

Security Vulnerabilities and Smart Contract Risks

Smart contracts, while innovative, are susceptible to vulnerabilities and exploits.

-

Exploits and Vulnerabilities: Security breaches can lead to significant financial losses and erode investor confidence.

-

Examples:

- Past security incidents have shown the potential for significant losses and negative impacts on the Ethereum ecosystem.

Conclusion

Several factors suggest potential for an Ethereum uptrend: the successful Merge, the growth of layer-2 solutions, and the continued development of the DeFi and NFT ecosystems. However, significant risks remain, including regulatory uncertainty, competition from other blockchains, and the ever-present risk of security vulnerabilities. While many positive indicators exist for the Ethereum price, a cautious approach is warranted. While several factors suggest potential for an Ethereum uptrend, several risks remain. Careful consideration of these variables is crucial before making any investment decisions. Stay informed about the latest developments in the Ethereum ecosystem and continue to monitor the Ethereum price to make your own informed assessment of whether an uptrend is likely. Understanding the nuances of the Ethereum price forecast requires diligent research and a balanced perspective.

Featured Posts

-

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League Quarterfinal

May 08, 2025 -

Counting Crows 1995 Snl Performance A Career Defining Moment

May 08, 2025

Counting Crows 1995 Snl Performance A Career Defining Moment

May 08, 2025 -

X Mens Rogue Costume Changes And Their Significance

May 08, 2025

X Mens Rogue Costume Changes And Their Significance

May 08, 2025 -

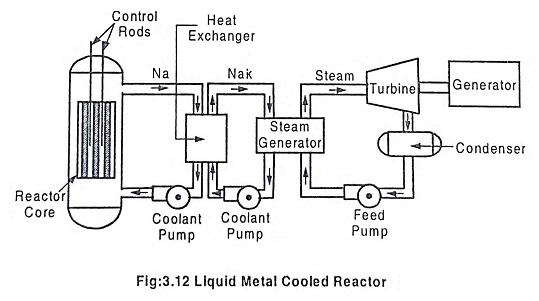

Inside The Ps 5 Pro Analysis Of The Liquid Metal Cooling Implementation

May 08, 2025

Inside The Ps 5 Pro Analysis Of The Liquid Metal Cooling Implementation

May 08, 2025

Latest Posts

-

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025

The Xrp Etf Outlook Weighing Supply Headwinds Against Potential Growth

May 08, 2025 -

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Demand Imbalance

May 08, 2025 -

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Low Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025