Live Stock Market Updates: Dow Futures, Bitcoin Rally, Bond Sell-Off

Table of Contents

Dow Futures: A Detailed Look at Today's Movement

The Dow Futures have shown significant movement today, reflecting the overall uncertainty in the market. Analyzing the precise direction and magnitude is crucial for understanding the broader market sentiment. Several factors likely contributed to these fluctuations. Recent economic data releases, particularly those concerning inflation and unemployment, can significantly impact investor confidence and trading activity. Geopolitical events, both domestic and international, also play a substantial role, often creating volatility as investors react to unfolding situations. Finally, the release of corporate earnings reports from major companies can trigger substantial buying or selling pressure depending on the performance reported.

- Opening price and current price of Dow Futures: [Insert actual data here – e.g., Opened at 34,200, currently at 34,350]

- Percentage change from the previous day's closing: [Insert actual data here – e.g., +0.44%]

- Key resistance and support levels: [Insert actual data here – e.g., Resistance at 34,500, support at 34,000]

- Technical analysis insights: [Insert relevant technical analysis – e.g., The upward trend suggests bullish sentiment, but the proximity to resistance levels indicates potential for a pullback.]

Keywords: Dow Futures, Dow Jones, Futures Trading, Stock Market Index

Bitcoin Rally: Understanding the Crypto Market Surge

Bitcoin experienced a significant price surge today, adding to the already volatile market conditions. This rally has sent shockwaves through the cryptocurrency market, prompting many to question the underlying causes. Several factors might be at play. Positive regulatory developments, particularly in jurisdictions with a large crypto market presence, can significantly boost investor confidence and drive prices upward. Increasing institutional investment, with larger companies and financial institutions allocating more capital to Bitcoin, also contributes to price appreciation. Finally, technological advancements within the Bitcoin network itself, such as improvements in scalability or security, can attract more users and increase demand.

- Bitcoin's current price and percentage change: [Insert actual data here – e.g., Current price: $28,500, +5%]

- Trading volume and market capitalization: [Insert actual data here – e.g., Trading volume significantly increased, market cap nearing $600 billion]

- Analysis of Bitcoin's technical indicators: [Insert technical analysis here – e.g., RSI nearing overbought territory, suggesting a potential correction.]

- Impact on the broader cryptocurrency market (altcoins): [Insert information here – e.g., Altcoins generally followed Bitcoin's upward trend, experiencing gains across the board.]

Keywords: Bitcoin price, Bitcoin rally, Cryptocurrency market, Crypto trading, Bitcoin news

Bond Sell-Off: Implications for the Fixed Income Market

A notable bond sell-off is currently impacting the fixed income market. This indicates a shift in investor sentiment and has significant implications for the broader economy. Rising interest rates are often the primary driver behind bond sell-offs. As interest rates increase, the yield on newly issued bonds becomes more attractive, leading to a decline in the value of existing bonds with lower yields. Inflation concerns also play a critical role. When inflation rises, the real return on fixed-income investments decreases, pushing investors to seek higher-yielding alternatives.

- Yield changes in key government bonds (e.g., US Treasuries): [Insert actual data here – e.g., 10-year Treasury yield increased by 0.1%]

- Impact on bond prices and investor sentiment: [Insert analysis here – e.g., Bond prices have fallen, reflecting increased risk aversion among investors.]

- Relationship between bond yields and stock market performance: [Insert analysis here – e.g., Rising bond yields often correlate with decreased stock market performance.]

- Potential effects on the broader economy: [Insert analysis here – e.g., Higher borrowing costs could slow down economic growth.]

Keywords: Bond market, Bond yield, Fixed income, Interest rates, Bond sell-off

Conclusion

Today’s Live Stock Market Updates highlight a complex interplay of factors influencing various asset classes. The fluctuating Dow Futures, the Bitcoin rally, and the bond sell-off all contribute to a dynamic and uncertain market environment. Staying informed about these developments is critical for making informed investment decisions. To receive regular daily stock market updates and stay ahead of the curve, subscribe to our newsletter, follow us on social media for timely alerts, or visit our website for more in-depth analysis and real-time stock market updates. Don't miss out on crucial live stock market updates – your financial future depends on it!

Featured Posts

-

Open Ais Chat Gpt An Ftc Investigation And Its Implications

May 24, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Implications

May 24, 2025 -

Ferrari Care And Maintenance The Essential Gear You Need

May 24, 2025

Ferrari Care And Maintenance The Essential Gear You Need

May 24, 2025 -

M56 Traffic Cheshire And Deeside Facing Significant Delays Due To Accident

May 24, 2025

M56 Traffic Cheshire And Deeside Facing Significant Delays Due To Accident

May 24, 2025 -

A Realistic Look At Escaping To The Country Challenges And Rewards

May 24, 2025

A Realistic Look At Escaping To The Country Challenges And Rewards

May 24, 2025 -

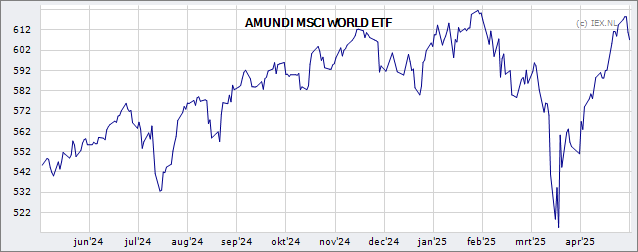

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Latest Posts

-

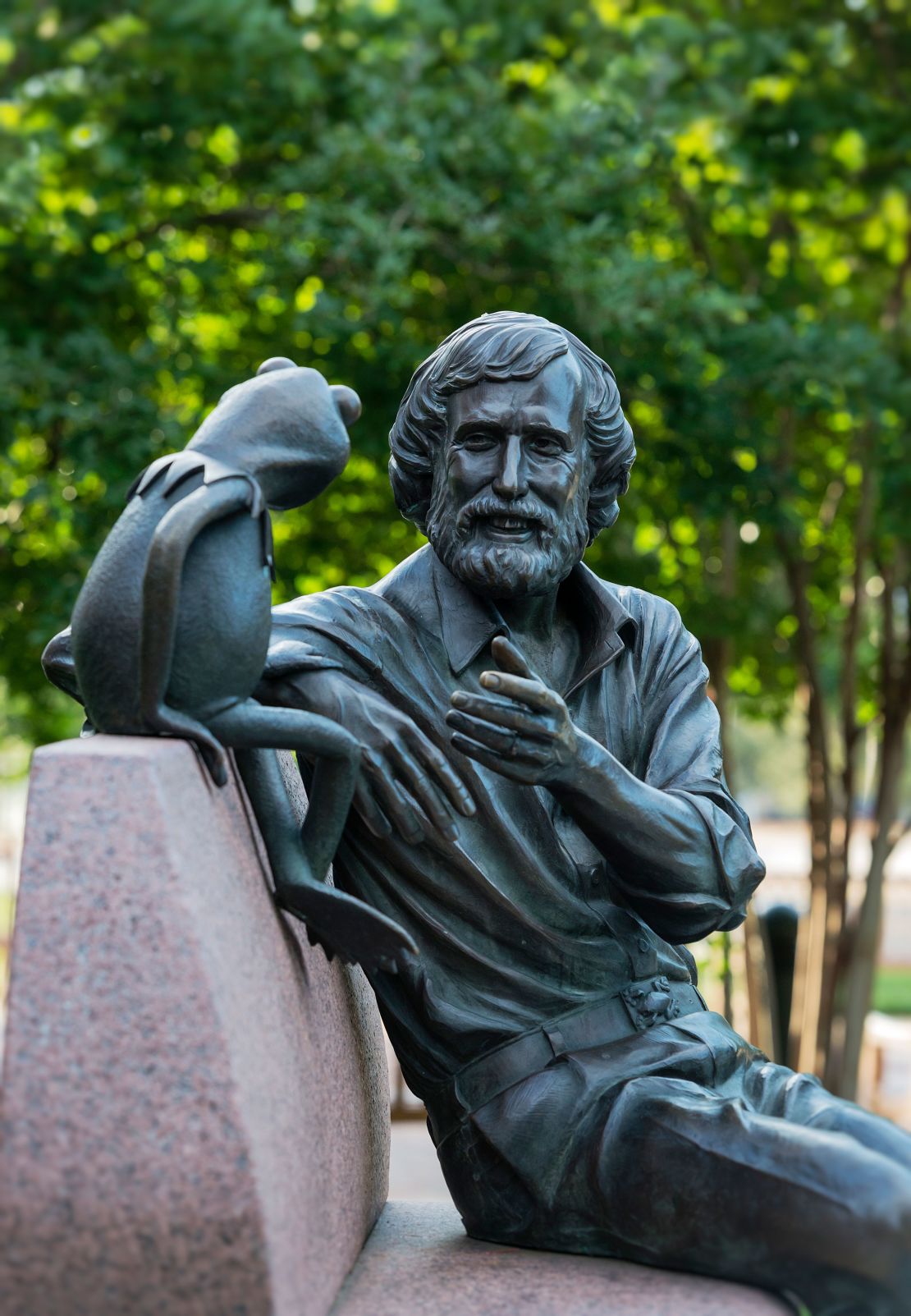

Kermit The Frog University Of Maryland 2025 Graduation Speaker

May 24, 2025

Kermit The Frog University Of Maryland 2025 Graduation Speaker

May 24, 2025 -

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy

May 24, 2025

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy

May 24, 2025 -

Lithuanian Gaubas Scores Victory Over Shapovalov In Rome

May 24, 2025

Lithuanian Gaubas Scores Victory Over Shapovalov In Rome

May 24, 2025 -

Aleksandrova Vybila Samsonovu V Pervom Raunde Turnira V Shtutgarte

May 24, 2025

Aleksandrova Vybila Samsonovu V Pervom Raunde Turnira V Shtutgarte

May 24, 2025 -

Aleksandrova Pobedila Samsonovu V Shtutgarte Itogi Pervogo Kruga

May 24, 2025

Aleksandrova Pobedila Samsonovu V Shtutgarte Itogi Pervogo Kruga

May 24, 2025