LVMH Stock Slumps: 8.2% Fall After Q1 Sales Figures

Table of Contents

Q1 Sales Figures Fall Short of Expectations

LVMH's Q1 2024 sales figures revealed a less-than-stellar performance, failing to meet analysts' expectations and falling short of the previous year's growth trajectory. While the company did report overall growth, it was significantly lower than projected. This underperformance was felt across several key divisions.

-

Fashion & Leather Goods: This division, a major revenue driver for LVMH, saw sales growth of 5%, considerably below the projected 8% growth predicted by analysts. This slower-than-expected growth suggests challenges in maintaining momentum in this core segment.

-

Wines & Spirits: The Wines & Spirits sector experienced a slight 2% decline in revenue, a concerning trend considering the typically strong performance of this division. This downturn may indicate shifts in consumer preferences or macroeconomic pressures.

-

Perfumes & Cosmetics: This sector showed a more robust performance, with growth of 10%, but this was still slightly below market projections of 12%.

[Insert chart/graph here showing Q1 sales figures for each division. Alt text: "LVMH Q1 2024 Sales Performance by Division - Chart showing sales growth in Fashion & Leather Goods, Wines & Spirits, and Perfumes & Cosmetics."]

Impact of Macroeconomic Factors

The global economic climate significantly influenced LVMH's Q1 performance. Several macroeconomic factors contributed to the decreased demand for luxury goods.

-

High Inflation: Soaring inflation rates eroded consumer purchasing power, leading to reduced spending on discretionary items like luxury handbags, watches, and champagne. Consumers prioritized essential spending, impacting demand for LVMH products.

-

Rising Interest Rates: Increased interest rates made borrowing more expensive, impacting consumer confidence and reducing investment capacity. This dampened luxury spending, affecting LVMH's sales across various product categories.

-

Recessionary Fears: Growing concerns about a potential global recession further discouraged consumer spending on luxury goods, which are often viewed as non-essential purchases during economic uncertainty.

Geopolitical Instability and Supply Chain Issues

Geopolitical instability and ongoing supply chain disruptions further complicated LVMH's Q1 performance.

-

War in Ukraine: The ongoing conflict in Ukraine impacted supply chains, creating disruptions in raw material sourcing and logistics, affecting production and delivery times.

-

China-US Relations: Strained geopolitical relations between China and the United States added complexity to international trade and impacted LVMH's sales and operations in key markets.

-

Global Supply Chain Bottlenecks: Beyond geopolitical factors, broader global supply chain bottlenecks continued to pose challenges, contributing to delays and increased costs.

Competitive Landscape and Market Saturation

LVMH faces a competitive landscape within the luxury goods sector. Increased competition and potential market saturation in certain segments may have contributed to its underperformance.

-

Strong Competitor Performance: Several key competitors within the luxury goods industry reported stronger Q1 sales growth, highlighting the increased competitive pressure LVMH is facing.

-

Market Saturation: In some product categories, market saturation may have limited LVMH's ability to achieve significant growth, requiring the company to innovate and explore new market segments.

Investor Reaction and Future Outlook

The 8.2% drop in LVMH stock price immediately following the Q1 sales release reflects investor concern about the company's performance. Analysts' comments vary, with some predicting a recovery in subsequent quarters while others express caution.

-

Analyst Predictions: Some analysts believe LVMH will rebound in the coming quarters, citing the company's strong brand recognition and long-term potential.

-

Potential Strategies: LVMH may need to implement strategies to address the challenges, such as cost-cutting measures, focusing on high-growth markets, and continuing to innovate its products and marketing strategies.

Conclusion: Analyzing the LVMH Stock Slump and Looking Ahead

The significant drop in LVMH stock price following its Q1 sales figures highlights the impact of macroeconomic headwinds, geopolitical uncertainty, and increased competition within the luxury goods sector. While LVMH remains a powerful brand, the company faces challenges that require strategic adaptation. The future outlook for LVMH stock remains uncertain, depending on the company's ability to navigate these complexities and regain its growth momentum. Stay informed about future developments in LVMH stock and its performance by subscribing to our newsletter for regular updates on luxury goods market trends.

Featured Posts

-

All Resolutions Adopted At Imcd N V S Agm

May 24, 2025

All Resolutions Adopted At Imcd N V S Agm

May 24, 2025 -

Desempenho Excepcional Ferrari 296 Speciale Com Motor Hibrido De 880 Cv

May 24, 2025

Desempenho Excepcional Ferrari 296 Speciale Com Motor Hibrido De 880 Cv

May 24, 2025 -

New Music Joy Crookes Shares Haunting Track I Know You D Kill

May 24, 2025

New Music Joy Crookes Shares Haunting Track I Know You D Kill

May 24, 2025 -

Essen Der Neue Eis Trend In Nordrhein Westfalen

May 24, 2025

Essen Der Neue Eis Trend In Nordrhein Westfalen

May 24, 2025 -

Essener Leistungstraeger Golz Und Brumme Ein Genauerer Blick

May 24, 2025

Essener Leistungstraeger Golz Und Brumme Ein Genauerer Blick

May 24, 2025

Latest Posts

-

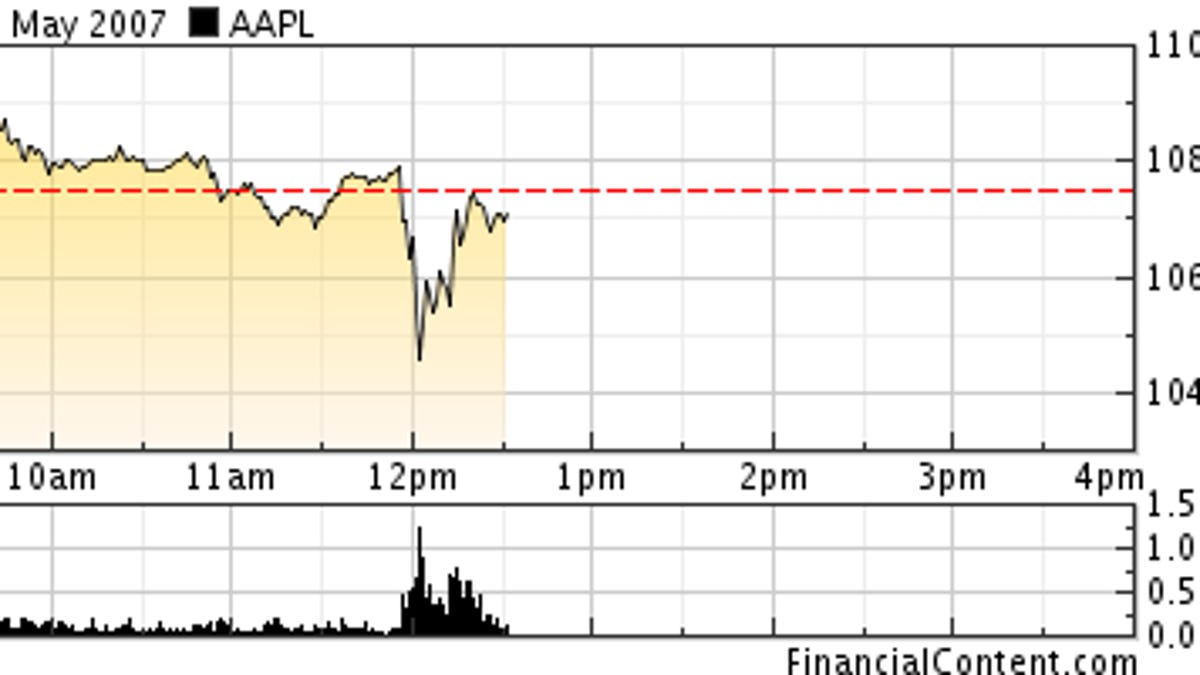

Apple Stock Suffers Setback Amidst Tariff Announcement

May 24, 2025

Apple Stock Suffers Setback Amidst Tariff Announcement

May 24, 2025 -

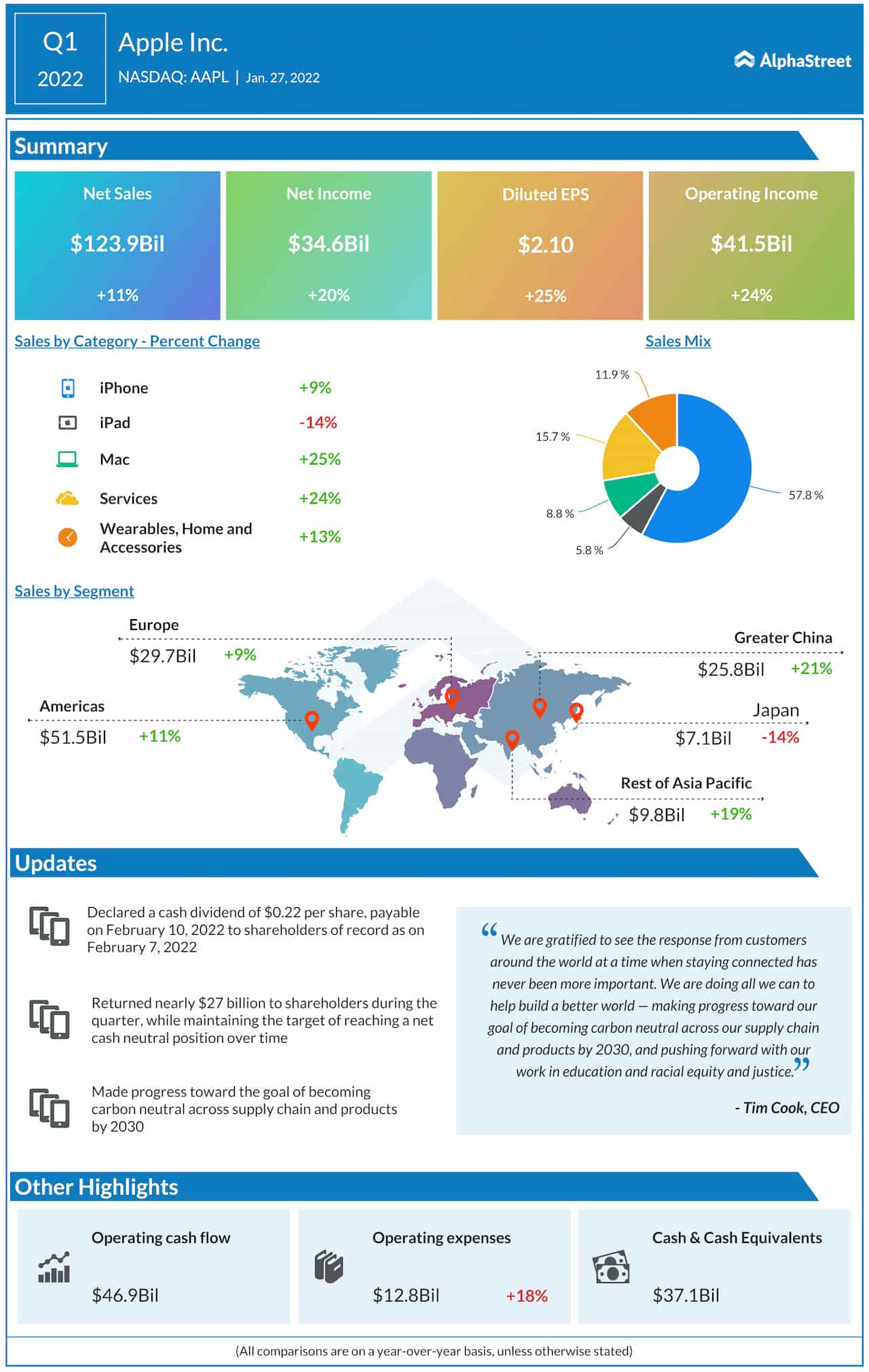

Investing In Apple Stock A Look At Q2 Performance And Implications

May 24, 2025

Investing In Apple Stock A Look At Q2 Performance And Implications

May 24, 2025 -

Apple Stock Plunges On 900 Million Tariff Projection

May 24, 2025

Apple Stock Plunges On 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025

Apple Stock Outlook Analyzing Q2 Results And Future Growth

May 24, 2025 -

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 24, 2025