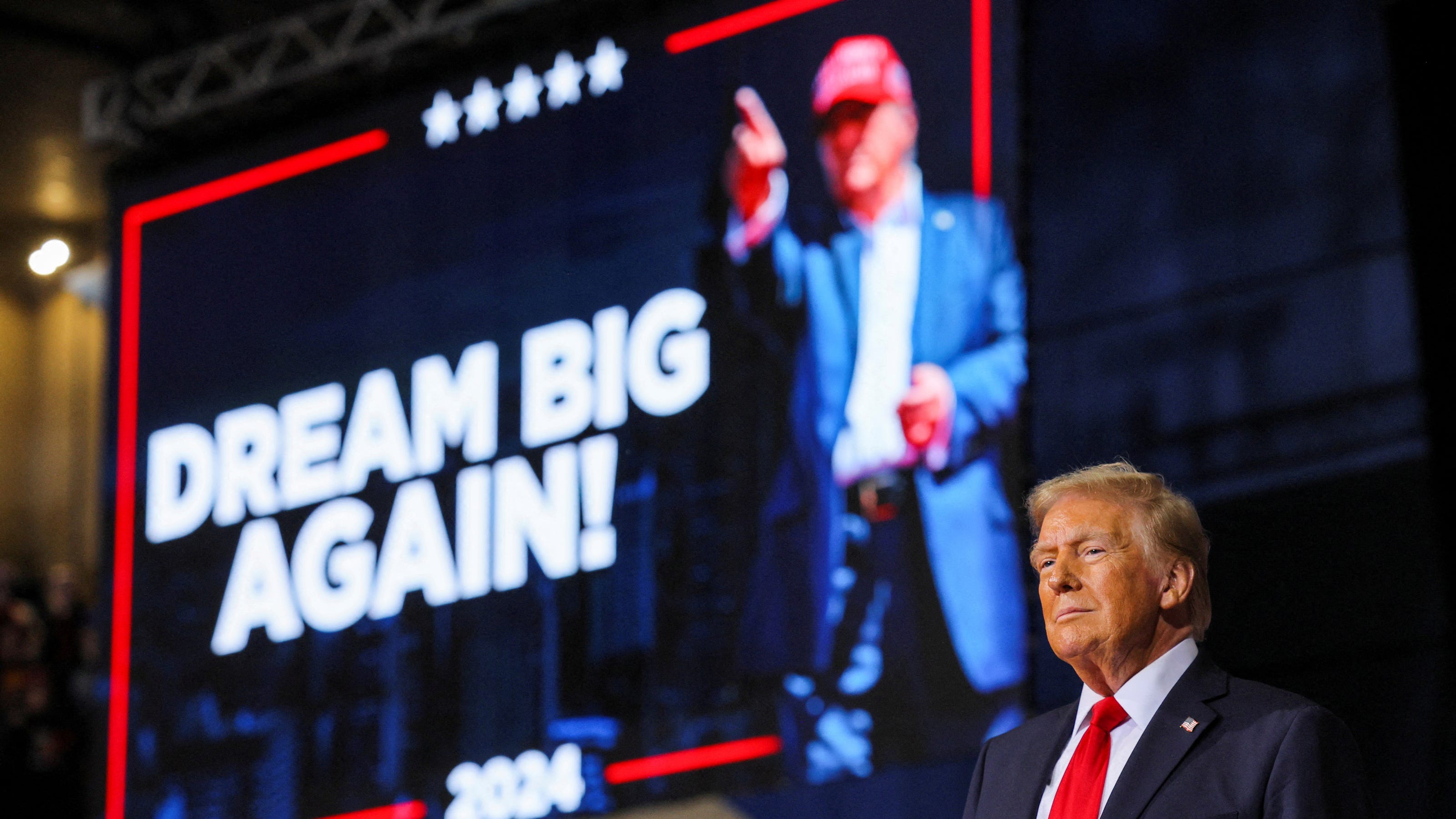

Trump's Tariff Relief Hints Boost European Markets; LVMH Dips

Table of Contents

European Market Response to Tariff Relief Hints

Positive Impact on Specific Sectors

The potential easing of Trump's tariffs sparked a wave of optimism in several key European sectors. The reduced threat of increased import duties led to a noticeable positive stock market reaction in many areas.

- Automotive: Automakers saw significant stock price increases, with shares in several major companies rising by as much as 5% in the days following the news. Reduced import costs on US-made parts and increased competitiveness in the US market fueled this surge.

- Manufacturing: Companies in the manufacturing sector, particularly those reliant on US components, also benefited from the anticipated tariff relief. The potential for lower production costs translated into improved profit margins and boosted investor confidence.

- Technology: Several tech companies experienced a positive market reaction. Reduced tariffs on imported components made their products more competitive and cheaper to produce.

These positive responses are directly attributable to the potential for reduced import duties and increased competitiveness within the US market. The European Union trade relationship with the US is highly complex, and this instance demonstrates the volatility inherent in that relationship.

Reasons for Market Volatility

Despite the generally positive response, market volatility remained high. The uncertainty surrounding the actual implementation of Trump's tariff relief was a major contributing factor. Speculation played a significant role, with investor sentiment shifting rapidly based on conflicting reports and statements from US officials.

- Uncertainty: The lack of clarity surrounding the timeline and scope of any potential tariff changes created considerable uncertainty. Investors remained hesitant to make significant commitments until concrete details emerged.

- Speculation: Market speculation ran rampant, with rumors and contradictory news reports driving short-term fluctuations. This highlighted the susceptibility of markets to even the hint of policy changes.

- Investor Confidence: Investor confidence was fragile, fluctuating based on the latest news updates. This highlights the importance of clear and consistent communication from policymakers.

LVMH's Unexpected Dip Despite Potential Tariff Relief

Analyzing LVMH's Performance

The luxury goods sector, often seen as a barometer of global economic health, showed a contrasting response. LVMH, the world's largest luxury goods company, experienced a surprising dip in its stock price despite the generally positive market sentiment surrounding potential Trump's tariff relief.

- Specific Factors: The decline in LVMH's stock price is likely due to several factors specific to the luxury goods sector, including concerns about slowing consumer spending in key markets and increased competition.

- Consumer Spending: Fears of reduced consumer spending, particularly in the US and China, played a role in the dip. The luxury goods market is highly sensitive to shifts in consumer confidence and disposable income.

- Stock Price Decrease: LVMH's stock price fell by approximately 2% within the period following the news, signifying a distinct deviation from the overall market trend.

This underscores the sector-specific nature of responses to macroeconomic events and demonstrates that even positive external factors don't guarantee success across all industries.

Contrasting LVMH's Situation with Other Sectors

The contrast between LVMH's performance and that of other sectors highlights the importance of considering sectoral differences when analyzing market reactions to policy changes.

- Sectoral Differences: The luxury goods sector's sensitivity to economic downturns and shifts in consumer behavior makes it different from sectors like automotive or manufacturing, which directly benefit from reduced import costs.

- Comparative Analysis: A comparative analysis of different sectors emphasizes the need for nuanced market assessments and risk management strategies. The luxury versus non-luxury goods contrast is a prime example of this.

The Geopolitical Implications of Trump's Tariff Policies

Impact on US-EU Trade Relations

Trump's tariff policies have had significant and lasting implications for US-EU trade relations. These policies have strained the relationship, raising concerns about the future of trade agreements and collaborations.

- Trade Wars: The imposition of tariffs has led to retaliatory measures from the EU, escalating trade tensions and creating uncertainty for businesses on both sides of the Atlantic.

- Geopolitical Risks: The resulting trade tensions exacerbate existing geopolitical risks and raise questions about the future direction of global trade.

- Bilateral Agreements: The possibility of future bilateral agreements remains uncertain, raising concerns about the long-term stability of the transatlantic economic partnership.

Long-Term Effects on Global Markets

The long-term effects of Trump's tariff policies on global markets remain uncertain but could significantly impact economic growth and stability.

- Global Economy: The imposition of tariffs can lead to increased prices for consumers, reduced trade volumes, and disruptions to global supply chains.

- Economic Forecasting: Predicting the long-term economic consequences is challenging due to the complex interplay of various economic factors.

- Market Predictions: Market predictions vary widely, highlighting the uncertainty surrounding the ultimate impact of these policies.

Conclusion

Trump's potential tariff relief has had a mixed impact on European markets, with some sectors enjoying gains while others, like LVMH, experienced unexpected dips. This highlights the complex and often unpredictable nature of market reactions to trade policy changes. The geopolitical implications are substantial, impacting US-EU relations and potentially influencing global economic growth. The situation underscores the need for careful analysis and risk management, highlighting the inherent volatility within the global economy. Stay tuned for further updates on Trump's tariff relief and its impact on global markets. Subscribe to our newsletter for the latest analysis and insights.

Featured Posts

-

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Relx Trotseert Economische Zwakte Ai Drijft Groei En Winstgevendheid

May 24, 2025

Relx Trotseert Economische Zwakte Ai Drijft Groei En Winstgevendheid

May 24, 2025 -

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025 -

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Latest Posts

-

Sean Penns Allegiance To Woody Allen A Blind Spot In The Me Too Movement

May 24, 2025

Sean Penns Allegiance To Woody Allen A Blind Spot In The Me Too Movement

May 24, 2025 -

Sean Penns Recent Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Appearance A Detailed Look At The Controversy

May 24, 2025 -

Sean Penn And Woody Allen Examining A Persistent Me Too Controversy

May 24, 2025

Sean Penn And Woody Allen Examining A Persistent Me Too Controversy

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025