Understanding High Stock Market Valuations: A BofA Perspective For Investors

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors have propelled stock market valuations to historically high levels. A BofA analysis points to a confluence of macroeconomic conditions and investor sentiment as the primary drivers. Let's examine the key contributors:

-

Low Interest Rates and Monetary Policy: The prolonged period of low interest rates, a consequence of quantitative easing (QE) programs implemented by central banks globally, has significantly impacted investment decisions. With bond yields remaining subdued, investors have sought higher returns in the equity market, driving up demand and valuations. BofA's analysis highlights this as a significant factor in the current high stock market valuations, particularly in the post-2008 financial crisis era. This shift in capital allocation has been a consistent theme in BofA's market reports.

-

Strong Corporate Earnings (Despite Inflation): While inflation has undoubtedly posed challenges, many companies have demonstrated remarkable resilience, maintaining or even exceeding earnings expectations. BofA's research indicates that strong corporate profit margins, coupled with efficient cost management strategies, have played a crucial role in supporting high stock prices. This is particularly evident in certain sectors less sensitive to inflationary pressures. Analyzing BofA's sector-specific reports can provide further insights into which companies are best positioned for continued growth.

-

Positive Investor Sentiment and Risk Appetite: A prevailing optimistic outlook among investors contributes to heightened demand for equities. This positive investor sentiment, often fueled by expectations of continued economic growth and technological innovation, has further inflated stock prices. BofA's market sentiment indicators, which track investor confidence and risk appetite, reflect this positive trend. However, it's crucial to note that periods of high optimism can also precede market corrections.

-

Technological Advancements and Growth Sectors: The rapid pace of technological innovation and the emergence of high-growth sectors, such as technology, biotechnology, and renewable energy, have attracted significant investor interest. These sectors often exhibit higher valuations due to their growth potential, further contributing to the overall high stock market valuations. BofA's research consistently identifies key players and growth opportunities within these dynamic sectors.

Assessing the Risks Associated with High Valuations

While high stock market valuations can indicate strong economic fundamentals, they also carry inherent risks. Understanding these risks is paramount for informed investment decision-making. A BofA perspective highlights the following key concerns:

-

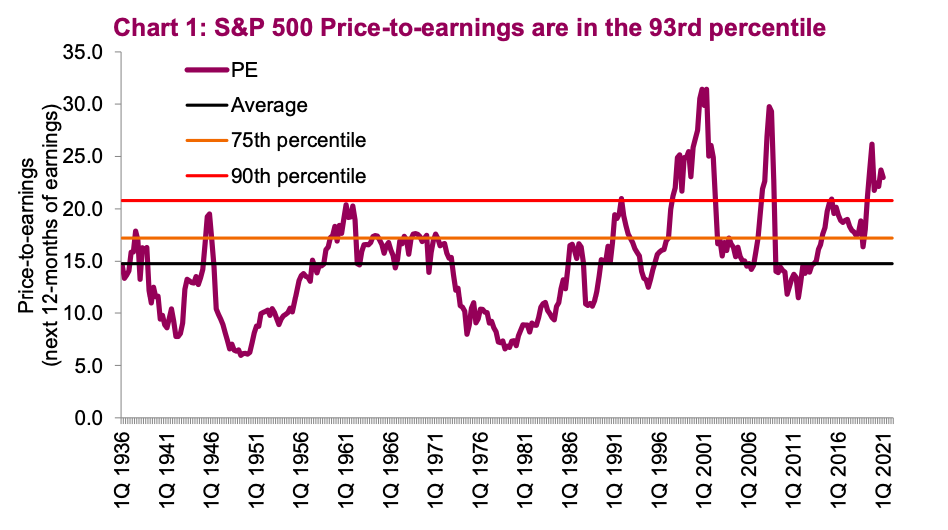

Elevated Valuation Metrics: Traditional valuation metrics, such as the price-to-earnings ratio (P/E) and the price-to-sales ratio (P/S), are currently elevated relative to historical averages. These high valuations suggest that the market might be pricing in excessive optimism or overlooking potential downside risks. BofA's analysis of these key valuation metrics provides crucial context for understanding the level of risk.

-

Increased Market Volatility: Markets with high valuations tend to exhibit increased sensitivity to economic news and unexpected events, leading to greater volatility. Sharp corrections become more likely when valuations are stretched. BofA's volatility forecasts, based on sophisticated models, provide insights into potential market swings and help investors manage risk.

-

Potential for a Market Correction: Although predicting market corrections with precision is impossible, the risk of a significant downturn is undeniably higher in a market characterized by high valuations. BofA's research explores potential triggers for a correction, such as rising interest rates, unexpected inflation spikes, or geopolitical events. Understanding these potential triggers is crucial for effective risk management.

BofA's Investment Strategies for a High-Valuation Market

Navigating a high-valuation market requires a strategic approach that prioritizes risk management and diversification. BofA recommends the following investment strategies:

-

Diversification Across Asset Classes: Diversifying investments across various asset classes, including equities, bonds, real estate, and alternative investments, is crucial for mitigating risk. This reduces the impact of any single asset class underperforming. BofA's asset allocation models can help investors design portfolios tailored to their individual risk tolerance and investment goals.

-

Strategic Asset Allocation: Careful asset allocation, based on a thorough understanding of individual risk tolerance and investment objectives, is paramount. BofA's financial advisors can guide investors in developing appropriate asset allocation strategies that balance risk and return within the current high-valuation market.

-

Considering Defensive Stocks: Investing in sectors considered less vulnerable to economic downturns, such as consumer staples and utilities, can offer a degree of protection against market corrections. BofA's analysts identify potential defensive stocks and sectors that offer relative stability in a volatile market.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is crucial for weathering short-term market fluctuations. BofA emphasizes the importance of a long-term perspective, encouraging investors to focus on their long-term goals rather than reacting to short-term market noise.

Conclusion

Understanding high stock market valuations is critical for investors navigating the current market. BofA's analysis highlights several factors contributing to these high valuations, including low interest rates and strong corporate earnings, but also emphasizes the associated risks, particularly increased market volatility and the potential for a correction. By implementing a diversified investment strategy, carefully managing risk, and adopting a long-term perspective, investors can better position themselves to succeed even in a market characterized by high stock market valuations. Consult with a financial advisor and leverage BofA's research and resources to refine your understanding of high stock market valuations and craft a robust investment strategy. Don't underestimate the importance of understanding and actively managing your exposure to high stock market valuations.

Featured Posts

-

Proposed French Law Banning Hijabs In Public For Under 15s

May 25, 2025

Proposed French Law Banning Hijabs In Public For Under 15s

May 25, 2025 -

Georgia Man Charged With Murder 19 Years After Wifes Killing And Nannys Disappearance

May 25, 2025

Georgia Man Charged With Murder 19 Years After Wifes Killing And Nannys Disappearance

May 25, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025 -

Analysis Trumps Decision On Nippon U S Steel Merger

May 25, 2025

Analysis Trumps Decision On Nippon U S Steel Merger

May 25, 2025 -

900 Million Tariff Projection Triggers Apple Stock Sell Off

May 25, 2025

900 Million Tariff Projection Triggers Apple Stock Sell Off

May 25, 2025

Latest Posts

-

Zheng Qinwen Defeats Sabalenka For First Time Advances To Italian Open Semis

May 25, 2025

Zheng Qinwen Defeats Sabalenka For First Time Advances To Italian Open Semis

May 25, 2025 -

Tennis Participation Boom Nationwide Report Forecasts 25 Million Players By August 2024

May 25, 2025

Tennis Participation Boom Nationwide Report Forecasts 25 Million Players By August 2024

May 25, 2025 -

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 25, 2025

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 25, 2025 -

New Report Nationwide Tennis Participation To Exceed 25 Million By August 2024

May 25, 2025

New Report Nationwide Tennis Participation To Exceed 25 Million By August 2024

May 25, 2025 -

Report 25 Million Nationwide Tennis Players Projected By August 2024

May 25, 2025

Report 25 Million Nationwide Tennis Players Projected By August 2024

May 25, 2025