Understanding The Reasons Behind CoreWeave (CRWV)'s Thursday Stock Dip

Table of Contents

Market-Wide Downturn and Sectoral Weakness

Thursday's market saw a noticeable downturn, impacting various sectors, but particularly hitting technology stocks hard. This broader market correction played a significant role in CoreWeave's (CRWV) stock dip. Several factors contributed to this overall negative sentiment:

- Major Economic News: The release of unexpectedly high inflation data or concerns about rising interest rates could have triggered a general sell-off in the market, impacting even strong performers like CoreWeave.

- Tech Stock Underperformance: A comparison of the performance of other cloud computing stocks on Thursday reveals a similar trend. Many companies in the sector experienced declines, suggesting a sector-specific headwind rather than an issue solely impacting CRWV.

- General Technology Sell-Off: The technology sector, already under pressure due to rising interest rates and concerns about future growth, experienced a significant sell-off, dragging down even well-regarded companies like CoreWeave. This overall market trend exacerbated CRWV's individual challenges.

Specific Factors Affecting CoreWeave (CRWV)

While the market downturn contributed to CRWV's stock decline, specific factors related to the company itself likely exacerbated the drop. These include:

- Earnings Reports and Forecasts: Any negative news regarding CoreWeave's earnings reports or revised forecasts could have significantly impacted investor confidence. A missed earnings target or a less-than-optimistic outlook for future growth would likely cause a stock price decline.

- Partnerships and Contracts: Announcements regarding partnerships, contracts, or potential legal issues could also affect the stock price. A canceled major contract or a dispute with a key partner could negatively influence investor sentiment.

- Analyst Downgrades: A downgrade of CoreWeave's stock rating by a prominent financial analyst could trigger a sell-off as investors react to the negative assessment. Analyst opinions carry significant weight in influencing investor decisions.

Competition and Market Saturation

The cloud computing market is intensely competitive, with established giants and new entrants vying for market share. This competitive landscape significantly impacts CoreWeave's growth prospects:

- Major Competitors: Companies like AWS, Azure, and Google Cloud maintain substantial market share, creating significant competition for CoreWeave. The dominance of these established players presents a challenge for newer entrants.

- Disruptive Technologies: The emergence of new technologies and innovative approaches in AI infrastructure constantly shifts the competitive landscape. CoreWeave must adapt and innovate to stay ahead of the competition.

- Competitive Advantages and Vulnerabilities: Understanding CoreWeave's unique selling propositions (USPs) and potential vulnerabilities is crucial for assessing its future performance. Identifying its competitive advantages in the face of intense competition is critical to assessing its long-term viability.

Investor Sentiment and Speculation

Investor sentiment and speculation play a crucial role in stock price fluctuations. In CoreWeave's case, several factors likely influenced the Thursday stock dip:

- Social Media Sentiment: Negative sentiment expressed on social media platforms, news articles, and financial forums can impact investor confidence and lead to sell-offs.

- Short Selling Activity: Increased short-selling activity, where investors bet against the stock's price, can amplify downward pressure on the stock price.

- Overall Investor Confidence: A decline in overall investor confidence in the cloud computing sector, particularly in the AI infrastructure segment, could have contributed to the sell-off in CRWV stock.

Conclusion: Understanding and Navigating the CoreWeave (CRWV) Stock Dip

The CoreWeave (CRWV) stock dip on Thursday was likely a result of a confluence of factors: a broader market correction impacting the technology sector, specific company-related news (potential earnings concerns or contract issues), intense competition in the cloud computing and AI infrastructure markets, and prevailing investor sentiment. Understanding these market dynamics and company-specific news is crucial for navigating the volatility of the CRWV stock and similar cloud computing investments. Staying informed about market trends and company-specific news is crucial for successfully navigating the volatility of the CoreWeave (CRWV) stock and similar cloud computing investments. Continue your research and make informed decisions based on a thorough understanding of the factors influencing CRWV's stock price. Conduct thorough CoreWeave analysis before making any investment decisions in this dynamic sector.

Featured Posts

-

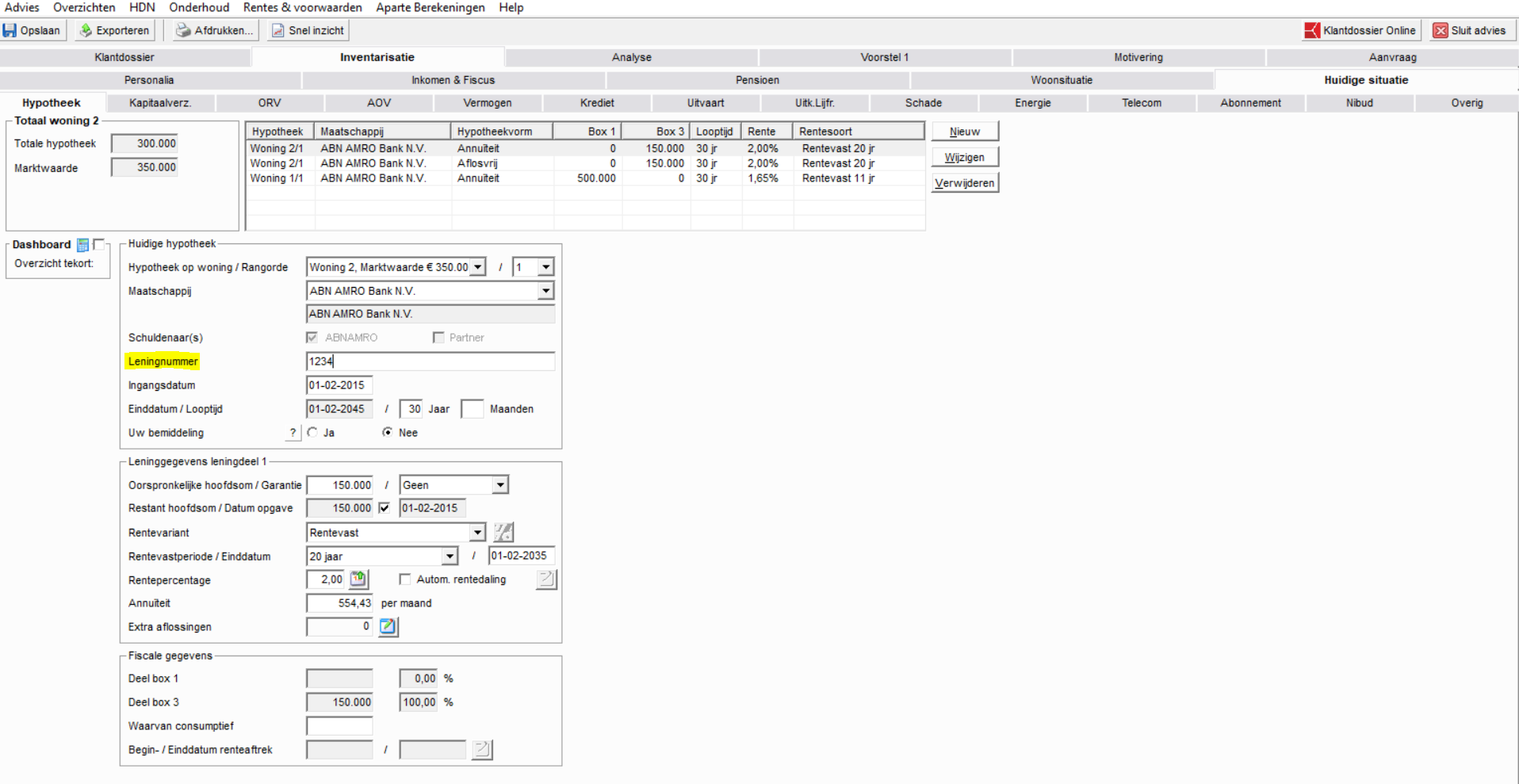

Abn Amro Florius En Moneyou Benoemen Karin Polman Als Directeur Hypotheken Intermediair

May 22, 2025

Abn Amro Florius En Moneyou Benoemen Karin Polman Als Directeur Hypotheken Intermediair

May 22, 2025 -

Zebra Mussel Infestation Found On New Boat Lift In Casper

May 22, 2025

Zebra Mussel Infestation Found On New Boat Lift In Casper

May 22, 2025 -

Real Madrid Manager Speculation Klopps Agent Speaks Out

May 22, 2025

Real Madrid Manager Speculation Klopps Agent Speaks Out

May 22, 2025 -

The Blake Lively Allegations Fact Or Fiction

May 22, 2025

The Blake Lively Allegations Fact Or Fiction

May 22, 2025 -

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 22, 2025

Abn Amro Rentedaling En Impact Op Huizenprijzen In Nederland

May 22, 2025

Latest Posts

-

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025

Steelers Schedule Release Key Takeaways And Analysis

May 22, 2025 -

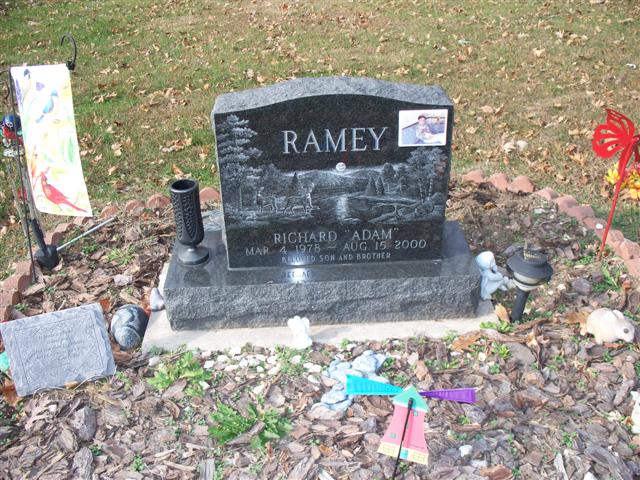

Music World Mourns Loss Of Dropout Kings Adam Ramey

May 22, 2025

Music World Mourns Loss Of Dropout Kings Adam Ramey

May 22, 2025 -

George Pickens Trade Rumors An Insider Debunks The Steelers Non Move

May 22, 2025

George Pickens Trade Rumors An Insider Debunks The Steelers Non Move

May 22, 2025 -

Steelers Pickens Why An Insider Says No Trade Happened

May 22, 2025

Steelers Pickens Why An Insider Says No Trade Happened

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Details Emerge

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Details Emerge

May 22, 2025