Understanding The Recent Spike In Bitcoin Mining Power

Table of Contents

The Role of Institutional Investment in Increased Bitcoin Mining Power

The growing involvement of large institutional investors is a major catalyst behind the increased Bitcoin mining power. These institutions, with their significant capital reserves, are entering the mining sector, establishing large-scale operations that significantly impact the overall hash rate. Their participation isn't just about profit; it's also a strategic move to gain a foothold in the cryptocurrency ecosystem and influence its direction.

- Increased capital inflow leading to larger mining farms: The sheer amount of capital injected by institutional investors allows them to build massive mining farms, deploying thousands of ASICs (Application-Specific Integrated Circuits) simultaneously.

- Acquisition of advanced mining hardware (ASICs): These institutions often purchase the latest and most efficient ASICs, giving them a competitive edge in mining profitability and contributing significantly to the overall hash rate.

- Economies of scale resulting in lower operational costs: Large-scale operations benefit from economies of scale, lowering their electricity and operational costs per Bitcoin mined, making them more resilient to price fluctuations.

Examples of this include major corporations and investment firms setting up dedicated mining operations or acquiring existing mining companies. This influx of institutional money directly translates into a larger number of mining rigs contributing to the network's overall hash rate.

Technological Advancements and Their Influence on Bitcoin Mining Hash Rate

The relentless pace of technological innovation in semiconductor technology has dramatically boosted Bitcoin mining hash rate. The development of more efficient and powerful ASICs is a key driver. These advancements translate directly into a higher hashing power per unit of energy consumed.

- Increased hashing power per chip: New generation ASICs boast significantly higher hashing power compared to their predecessors, allowing miners to solve complex cryptographic problems faster.

- Lower energy consumption per hash: Improvements in chip design and manufacturing processes have led to reduced energy consumption, making mining more profitable and environmentally sustainable (relatively).

- Improved cooling systems for higher efficiency: Advanced cooling solutions ensure optimal operating temperatures, further enhancing the efficiency and lifespan of mining hardware.

Leading manufacturers of specialized Bitcoin mining hardware are constantly pushing the boundaries of what's technologically possible, releasing new generations of ASICs that contribute to the ever-increasing hash rate.

The Impact of Regulatory Changes on Bitcoin Mining Activity

Government regulations significantly influence where and how Bitcoin mining takes place. Supportive policies attract miners, while restrictive ones can drive them elsewhere, affecting the overall global hash rate distribution.

- Tax incentives attracting miners: Some jurisdictions offer tax breaks or other incentives to attract Bitcoin miners, particularly those using renewable energy sources.

- Access to renewable energy sources: Regions with abundant and cheap renewable energy sources (hydropower, solar, wind) become more attractive for large-scale Bitcoin mining operations due to lower operational costs.

- Increased scrutiny and potential bans impacting hash rate: Conversely, stricter regulations, including outright bans or increased scrutiny, can lead to miners relocating their operations, potentially impacting the overall hash rate.

The regulatory landscape is constantly evolving, and its impact on the distribution and magnitude of Bitcoin mining power is a crucial factor to consider.

Network Security and the Significance of High Bitcoin Mining Power

The high Bitcoin mining hash rate is not merely a statistic; it's a critical component of Bitcoin's security. A higher hash rate makes it exponentially more difficult for malicious actors to launch a 51% attack, which would allow them to control the network and potentially reverse transactions.

- Increased difficulty in manipulating the blockchain: A higher hash rate increases the computational power required to control the network, making a 51% attack computationally infeasible and prohibitively expensive.

- Enhanced resistance to malicious attacks: The higher the hash rate, the more resilient the Bitcoin network becomes against various attacks, including double-spending attempts and other forms of manipulation.

- Improved decentralization and network resilience: A distributed network with a high hash rate is inherently more resilient to censorship and single points of failure, ensuring the continued operation of the Bitcoin network even under duress.

Conclusion: Understanding and Monitoring the Bitcoin Mining Power Trend

The recent spike in Bitcoin mining power is a result of several interacting factors: significant institutional investment, continuous technological advancements in mining hardware, and the influence of evolving regulatory environments. The high hash rate is paramount to maintaining Bitcoin's security and stability, safeguarding its decentralized nature and resisting malicious attempts to compromise the network. While predicting future trends is challenging, ongoing technological innovation and evolving regulatory landscapes will likely continue to shape the dynamics of Bitcoin mining power. Stay updated on the fluctuations in Bitcoin mining power to better understand the evolving landscape of the cryptocurrency market. Continue learning about the factors impacting Bitcoin mining hash rate to make informed decisions.

Featured Posts

-

Canada Post Strike What To Expect In Late Month

May 08, 2025

Canada Post Strike What To Expect In Late Month

May 08, 2025 -

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025

The Long Walk Trailer Released A Chilling Look At The Intense Thriller

May 08, 2025 -

Chkn Mtn Byf Lahwr Myn Gwsht Ky Qymtwn Ka Bhran

May 08, 2025

Chkn Mtn Byf Lahwr Myn Gwsht Ky Qymtwn Ka Bhran

May 08, 2025 -

New The Long Walk Trailer Exploring The Brutal World Of Kings Novel

May 08, 2025

New The Long Walk Trailer Exploring The Brutal World Of Kings Novel

May 08, 2025 -

Lotto Plus And Lotto Results Wednesday 2nd April 2025

May 08, 2025

Lotto Plus And Lotto Results Wednesday 2nd April 2025

May 08, 2025

Latest Posts

-

Support The Celtics Shop Official Merchandise At Fanatics

May 08, 2025

Support The Celtics Shop Official Merchandise At Fanatics

May 08, 2025 -

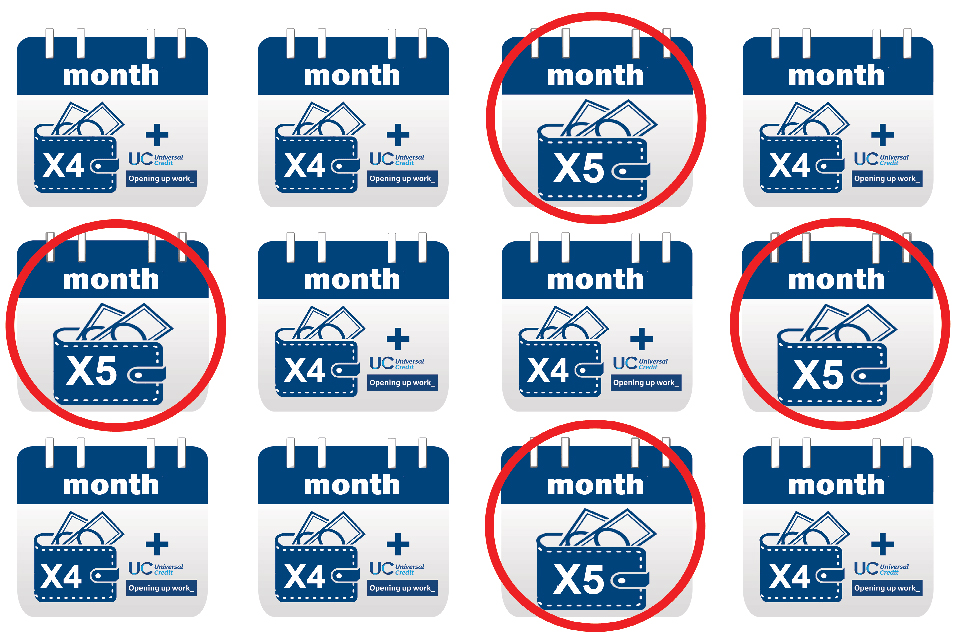

Dwp Universal Credit Are You Eligible For A Hardship Payment Refund

May 08, 2025

Dwp Universal Credit Are You Eligible For A Hardship Payment Refund

May 08, 2025 -

Jayson Tatum Bone Bruise Latest News And Game 2 Outlook

May 08, 2025

Jayson Tatum Bone Bruise Latest News And Game 2 Outlook

May 08, 2025 -

Find Your Perfect Boston Celtics Jersey And More At Fanatics

May 08, 2025

Find Your Perfect Boston Celtics Jersey And More At Fanatics

May 08, 2025 -

Universal Credit How To Claim Back Overpaid Hardship Payments From The Dwp

May 08, 2025

Universal Credit How To Claim Back Overpaid Hardship Payments From The Dwp

May 08, 2025